Smartphones remain the device of choice for gamers in Saudi Arabia, with nearly three quarters of users opting for the platform that offers convenience and portability, a study has found.

Around 73 per cent of gamers in the kingdom use smartphones, holding a significant advantage over other devices, the UK-based research firm YouGov said in a report on Wednesday.

Game consoles, which include the likes of the Microsoft Xbox, Sony PlayStation and Nintendo Switch, were second with 34 per cent, it said. Desktops and laptops followed with 33 per cent, and high-end gaming PCs with 14 per cent. Tablets also remain popular with about 25 per cent.

"Although mobile devices have opened the gates to casual gaming in a big way, the likes of Xbox and PlayStation continue to appeal to gaming enthusiasts with a third of weekly gamers using dedicated gaming consoles to play video games. Men are more likely than women to say this," YouGov analysts said.

This has made gaming the sixth biggest online activity, tied with watching non-live TV, YouGov said.

Interacting on social media remains the top online activity, with 41 per cent of those surveyed engaged in it, YouGov said.

This is followed by live content, non-live content such as those on YouTube, streaming video such as those on Netflix and Amazon Prime, and others such as surfing the web or checking emails, the study said.

Gaming has become big business globally, gaining traction during the Covid-19 pandemic in 2020, with New-Age technology providing both an opportunity to reach a wider audience and develop new titles to cater to consumer demand.

Saudi Arabia plans to develop 30 games and create about 40,000 jobs by 2030, as part of its National Gaming and Esports Strategy.

The programme, unveiled by Saudi Crown Prince Mohammed bin Salman in September, outlines a comprehensive investment programme for the industry and has the ultimate goal of making the kingdom a global gaming centre by 2030.

Riyadh also created the Saudi Esports Federation to hasten the industry's development. Its president, Prince Faisal bin Bandar, was appointed vice president of the Global Esports Federation in December.

Last month, the kingdom began hosting Gamers8, organised by the federation and one of the world’s largest gaming festivals, and Saudi residents have a positive perception of the event, data from YouGov shows.

About two-thirds of respondents agree with the statement: “Gamers8 will strengthen the kingdom's standing as future global hub for the gaming industry," it said.

Saudi Arabia's gaming industry also received a boost with new funding worth $488 million from the Saudi Esports Federation, the National Development Fund and the Social Development Bank, it was announced at the Leap technology conference in Riyadh in February.

Revenue in the global gaming market is projected to hit $212.4 billion by 2026, with mobile platforms continuing to lead the growth, market data platform Newzoo said last week in its August market update.

Meanwhile, the number of gaming start-ups in Saudi Arabia almost doubled to 24 in 2022, from 13 in the previous year, driven by incubation programmes, a report by game developer support system Nine66 said in December.

Gaming in Saudi Arabia also surpasses other online activities such as watching live streamed video content online, listening to radio, podcasts, reading a newspaper or book, or streaming music, the study showed.

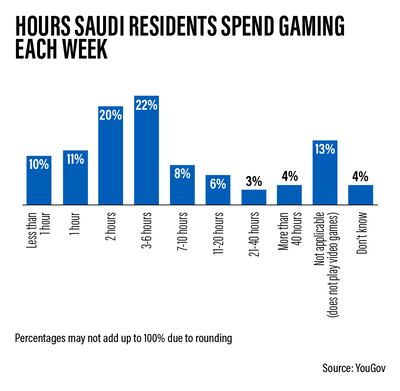

On how much time is spent on gaming each week, the biggest proportion, or 22 per cent, of Saudi residents said they spend about three to six hours, followed by a fifth that spend two hours, YouGov said.

The adoption of virtual reality headsets remains low, with only 9 per cent of weekly gamers using these devices during their gaming sessions, despite the gaming potential of VR and the steady rise of the metaverse, the study showed.