Revenue in the global gaming market is projected to hit $212.4 billion by 2026, with mobile platforms continuing to lead the growth, a new study has shown.

The figure would be up by more than 13 per cent from an estimated $187.7 billion in 2023, which represents a 2.6 per cent increase from 2022, as gaming “is now fully embedded in the mainstream”, market data platform Newzoo said in its August market update.

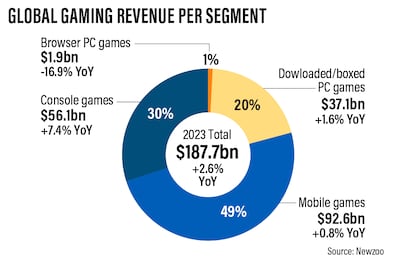

The revenue surge will be dominated by mobile games, which are seen to marginally grow 0.8 per cent and account for $92.6 billion, or nearly half of all revenue, this year, the Amsterdam-based company said.

Console games would be second with $56.1 billion, or 30 per cent of total revenue. The segment is also projected to log in the biggest annual increase of 7.4 per cent.

This will be followed by PC games with $37.1 billion (20 per cent), up 1.6 per cent year-on-year. Browser-based PC games will amass $1.9 billion (1 per cent of revenue), and is expected to post the biggest annual decline of nearly 17 per cent.

“Every year sees gaming become more mainstream … gaming’s impact will go beyond the number of players and revenue generated within the scope of the industry,” Tom Wijman, lead games analyst at Newzoo, wrote in the report.

The 2023 revenue projection is “staggering, which is an achievement given the many macroeconomic factors at play”, he said.

Gaming has become a big business globally, with new technology providing both an opportunity to reach a wider audience and develop new titles to cater to consumer demand.

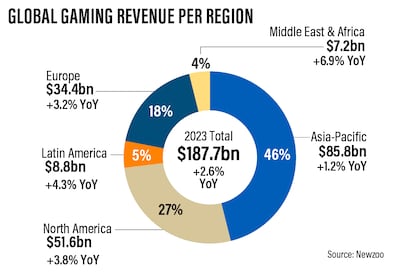

Regionally, Asia-Pacific will continue to lead revenue generation with an estimated $85.8 billion in 2023 for a 46 per cent market share, followed by North America with $51.6 billion (27 per cent), Europe with $34.4 billion (18 per cent) and Latin America with $8.8 billion (5 per cent).

The Middle East and Africa region, while expected to be last with $7.2 billion and a 4 per cent market share this year, is likely to post the biggest jump in revenue with nearly 7 per cent. The aforementioned four regions are to record growth of 1.2 per cent, 3.8 per cent, 3.2 per cent and 4.3 per cent respectively.

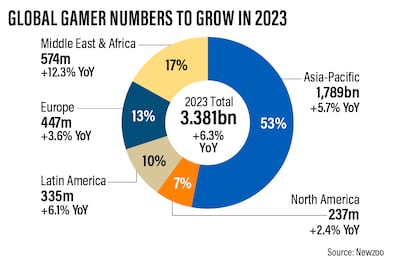

Revenue growth will be underpinned by a growing gamer population, which is projected to rise 6.3 per cent year-on-year and hit 3.381 billion players in 2023, Newzoo said.

Asia-Pacific will again have the biggest share with 1.789 billion, which is more than half of the market and up 5.7 per cent annually, with the Middle East and Africa this time jumping to second place with 574 million for a 17 per cent share and up 12.3 per cent.

Europe would be third with 447 million, good for a market share of 13 per cent, followed by Latin America with 335 million (10 per cent) and North America with 237 million (7 per cent).

The popularity of cloud gaming – a growing market dominated by a few services yet accounting for most paying users – has the potential to attract 43.1 million paying users by the end of 2023, with this number growing to 80.4 million by 2025, the report said.

The Middle East and Africa and Latin America, the two regions expected to log the biggest annual increases, will be driven by better internet infrastructure, accessible and affordable internet, and the rise of the middle class, Newzoo said.

The availability of gaming as an affordable recreational activity, thanks to free-to-play models and the increasing population of smartphone users, will also be a factor, it said.

Meanwhile, China's Tencent remains the biggest video gaming company by revenue with $7.56 billion, followed by Sony ($4.38 billion), Apple ($3.68 billion), Microsoft ($3.15 billion) and NetEase ($2.71 billion), according to Newzoo's latest data.

Rounding out the top 10 are Google, Activision Blizzard, Electronic Arts, Nintendo and Take-Two Interactive.