Smartphone shipments in the Middle East and Africa hit a seven-year low in 2022 as high inflation sapped consumer demand, a study by Counterpoint Research has shown.

Shipments declined more than 12 per cent to their lowest level since 2015, wiping out a strong start to the year.

The decline was mainly attributed to Russia's military offensive in Ukraine, which disrupted supply chains and caused prices to soar, the Hong Kong-based company said on Thursday.

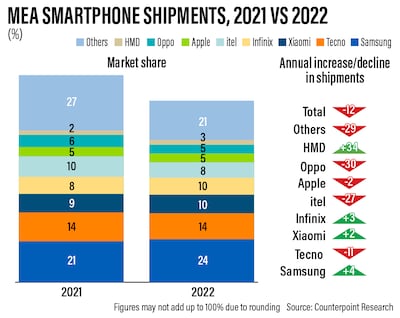

Samsung Electronics, the world's biggest mobile phone maker, maintained its comfortable lead in 2022 as its market share rose to 24 per cent, from 21 per cent in the previous year.

The South Korean technology company, which recently launched its new Galaxy S23 series, also increased its shipments by 4 per cent in 2022.

Samsung's growth in both metrics was a “terrific performance, given the market realities” and a tough fourth quarter, Yang Wang, a senior analyst at Counterpoint, wrote in the report.

“Much of the difficulties, such as high inflation rates, energy and food prices, and depreciating domestic currencies against the US dollar, were caused by factors outside of the control of market participants,” Mr Wang said.

“With the drop in consumer sentiment, OEMs [original equipment manufacturers] were put under enormous pressure and had to take drastic measures such as destocking, cutting marketing and channel spending, and taking a very careful approach to pricing.”

Counterpoint said in December that the downward trend was set to continue as global smartphone shipments declined in 2023, a swing from a previous growth forecast.

Shipments were projected to fall by 2 per cent annually to 1.26 billion units in 2023, compared with an estimated 1.24 billion in 2022, it said at the time.

“Consumer sentiment may have picked up marginally as the inflationary pressure and foreign currency headwinds receded. Still, the market environment remained very challenging,” Counterpoint said.

In 2022, the top smartphone brands in the Middle East and Africa were dominated by Transsion Holdings, a China-based manufacturer that is a top smartphone vendor in the African continent.

Its brands — Tecno, Infinix and itel — had market shares of 14 per cent, 10 per cent and 8 per cent, respectively, landing them in the second, fourth and fifth spots.

However, only Infinix posted shipment growth, adding 3 per cent in 2022, Counterpoint said. Tecno declined by 11 per cent and itel by 27 per cent.

“Aggressive destocking initiatives mostly bore fruit as Tecno and Infinix returned to launching higher-end devices during the shopping season,” Counterpoint said.

China's Xiaomi was third with a market share of about 10 per cent, with shipments inching up 2 per cent in 2022.

Apple's market share in the Middle East and Africa flattened at 5 per cent in 2022, keeping it outside of the top five. However, shipments of the iPhone maker fell 2 per cent annually.

The California technology company's market share increased due to broadened distribution in the region and the success of its iPhone 13 series, which fared better than the latest iPhone 14.

“However, sales have concentrated towards the higher-end iPhone 14 Pro and Pro Max models, thus replicating Apple’s value gains seen in other more developed markets,” Counterpoint said.

China's Oppo, which counts OnePlus as its subsidiary, and HMD Global, which revived the Nokia line-up, each had a 5 per cent market share but diverging shipments.

Oppo posted the biggest drop with 30 per cent while HMD recorded the best growth with 34 per cent.

One of the market highlights in the Middle East and Africa was the growth of the 5G category, in which smartphone shipments rose 47 percentage points to hit an 18 per cent market share, Counterpoint said.

“While 5G networks are only available in the GCC countries and certain pockets of Africa’s urban areas, the enthusiasm for 5G devices has been noted across the largest markets,” it said.

Samsung, which overtook Apple as the biggest 5G original equipment manufacturer in the Middle East and Africa, is “well positioned” to grow further through its large portfolio of mid-range A series devices.

Xiaomi and the Transsion brands are also expected to make a play in 2023.

“While, globally, 5G smartphone prices are coming down due to the availability of more affordable models, the proliferation of 5G devices in [the Middle East and Africa] will actually boost the average selling price in the region, as customers upgrade to more sophisticated devices,” Counterpoint said.