Mobile games have become the biggest and most accessible form of entertainment and relaxation for billions of people worldwide, including in the UAE, according to research by mobile advertising platform AdColony.

The industry surged during the early stages of the Covid-19 pandemic, when people started looking for new hobbies, AdColony said.

“No one can deny that we are living a stressful life and we are all looking for a fun escape. That is where mobile games are stepping in and make us forget our problems at least during the session time,” the report said.

The global mobile gaming market is expected to grow at a compound annual growth rate of 11 per cent to $272 billion by 2030, up from $98bn in 2020, according to ResearchAndMarkets. The category is already bigger than the PC and console gaming markets combined, contributing about 57 per cent of the $173bn in global video games revenue last year.

Big Tech companies have also sought to tap into the opportunity, such as Apple and Google, while in September, Netflix acquired its first game studio.

Sony and Microsoft, makers of the PlayStation and Xbox consoles, respectively, have also increasingly shifted to a cloud-based platform that allows users to access games from their mobile devices.

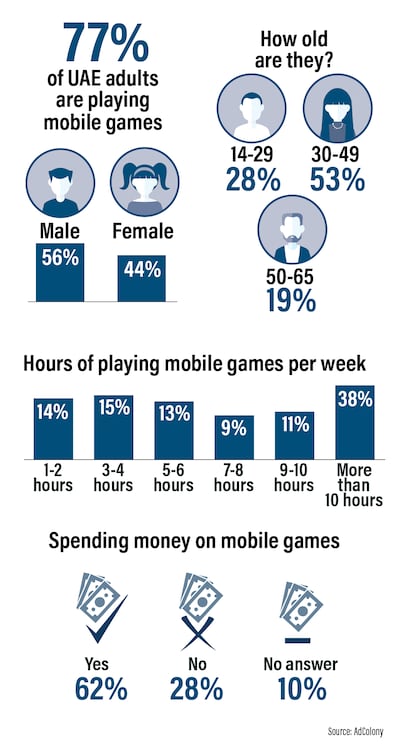

About 77 per cent of adults in the UAE are playing mobile games, with 56 per cent of them male, the AdColony research found. The perception that mobile games are solely for children is also irrelevant, with 53 per cent of respondents saying they are aged between 30 and 49.

Thirty-eight per cent spend more than 10 hours a week playing mobile games, while 48 per cent said they play at least two to three times per day. About 62 per cent said they play mobile games because it makes them relax and relieves stress, with 59 per cent also saying they find it entertaining.

Other activities are associated while playing mobile games, with 53 per cent saying they watch TV at the same time. This is followed by listening to music (50 per cent), checking social media platforms (48 per cent) and watching or streaming movies or TV series (42 per cent).

Mobile games have also developed into a mainstream platform for advertisers to capture audience attention and users have varying responses to this.

Twenty-eight per cent of respondents to the AdColony survey said they do not spend money on mobile games, while 68 per cent prefer to watch ads in return for game advantages rather than paying money. About 84 per cent said they like ads that reward them more than traditional video ads that do not offer any rewards.

“To expand new horizons and possibly new customers, brands need to arrange their media spending in accordance with the popular way. With a lot of different mobile advertisement models, rewarded advertising where the gamers watch the advertisement to gain lives, coins, or any free in-game material is very important,” the report said.