Google introduced new features on its Search, Maps and other apps that provide users with eco-friendly information to help them make more sustainable decisions.

The move is part of Alphabet-owned company's efforts to encourage sustainability.

"Climate change is no longer a distant threat – it’s increasingly local and personal. Around the world, wildfires, flooding and other extreme weather continue to affect our health, our economies and our future together on our planet," Sundar Pichai, chief executive of Alphabet and Google, said in a blog post.

"We need urgent and meaningful solutions to address this pressing challenge."

Google claims it was the first major company to become carbon neutral in 2007 and match its energy use with 100 per cent renewable energy in 2017. Last year, it committed to operate on 24/7 carbon-free energy by 2030.

Eco-friendly products are becoming mainstream as people are encouraged to contribute more to tackle climate change and its undesirable effects.

Data from Conservation International shows that July 2021 was the hottest month on record – 0.93 degrees Celsius higher than the 20th-century average – since records began in 1880. And as of that month, the concentration, or amount of gas by volume in the air, of carbon dioxide in Earth's atmosphere was the highest in history at 416 million parts per million.

Travel and shopping

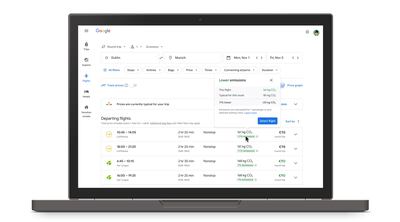

As part of its latest update, Google will display information about carbon emissions on its Flights service, where users can view emissions per seat and other carbon-friendly options that are readily available.

Sustainability efforts taken by hotels such as water conservation to waste reduction, as well as certifications by environment benchmark sites Green Key or EarthCheck, will also be displayed in searches to enable users to make an informed choice.

Richard Holden, Google's vice president of travel products, said they combined data from the European Environmental Agency with flight-specific information derived from airlines and other providers.

"It’s critical that people can find consistent and accurate carbon emissions estimates no matter where they want to research or book their trip."

Results on Google Shopping, meanwhile, will now display information on energy-intensive products such as water heaters and dishwashers, with suggestions to help narrow down results to sustainable options.

Maps

Maps, one of Google's most widely-used features, will also have a new eco-friendly routing. The service, which was announced earlier this year, shows fuel consumption data on routes, allowing users to choose the quickest and sustainable routes.

It also highlights the most eco-friendly route, even if it is not the fastest. The service is now live in the US but Google plans to expand this in Europe and other territories by next year.

Vehicles on the road account for more than 75 per cent of carbon dioxide emissions and are one of the largest contributors of greenhouse gases, according to Google, which quoted data from the International Energy Agency.

The US Environmental Protection Agency says a typical passenger vehicle emits about 4.6 metric tonnes of carbon dioxide annually.

Google also introduced lite navigation for cyclists, where important route details are displayed without the need to switching on a phone's screen or entering turn-by-turn navigation. The feature will be coming soon, the search engine company said.

Bike and scooter sharing information, meanwhile, is now available in 300 cities. The use of these vehicles have become a popular eco-friendly travel alternative. The use of biking directions on its Maps app have grown by up to 98 per cent, according to Google.

Clean energy at home

Nest, Google's smart home products unit, has introduced Nest Renew and its Energy Shift feature. The new service for Nest thermostats helps users automatically shift electricity usage for heating and cooling to times when energy is cleaner or less expensive. It also provides monthly impact reports that show how the entire Nest community has contributed to reducing emissions.

chief executive of Alphabet and Google

Data from RMI, a non-profit organisation advocating clean energy, shows that homes consume the most amounts of energy in the US, with household-level energy decisions driving 40 per cent of energy-related carbon emissions.

"Many people are eager to live more sustainably and help address one of our generation’s most profound challenges: climate change," Ben Brown, director of product management at Google, said in a blog post.

"The problem is that it can be hard to know where to start and whether you’re making a real difference."

Google also said that it was helping to develop new climate change solutions for its business customers, including for appliance maker Whirlpool, e-commerce company Etsy, British lender HSBC, consumer goods manufacturer Unilever and software company Salesforce. Google will also announce more sustainability options at its Cloud Next ‘21 event next week.