Samsung’s first-quarter profit slumped 40 per cent as consumers switched to Apple’s larger iPhones and the rising South Korean won made its devices more expensive in overseas markets.

Net income, excluding minority interests, fell to 4.52 trillion won (Dh15.5bn) in the three months ended March, the Suwon, South Korea-based company said in a filing on Wednesday. That compares with the 4.9tn-won average of 23 estimates compiled by Bloomberg and is the fourth straight decline.

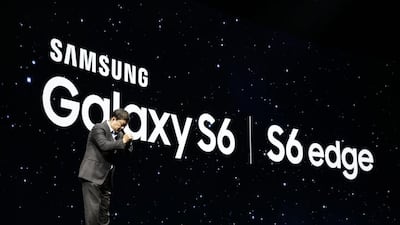

Samsung’s loss of its dominant position in smartphone sales to Apple and Chinese rivals is cutting profitability and forcing the company to lean more on the chip and display units as currency moves cut earnings by 800 billion won. Apple this week posted surging earnings with the South Korean company counting on winning back users with Galaxy S6 phones, which were released to positive reviews and strong demand that are said to have prompted an acceleration of curved-screen output.

• How to get the best deal on the Samunsg Galaxy S6 in the UAE

“Globally, demand for smartphones has been increasingly polarised to either top-end or bottom-end devices,” Lee Jae Yun, an analyst at Yuanta Securities Korea, said before the earnings release. “Galaxy devices have been squeezed somewhere in between, at least until the S6 came out.”

Shares of Samsung rose 0.6 per cent to 1,374,000 won as of 9.01am in Seoul. The stock has risen 3.6 per cent this year, compared with a 13 per cent gain in the benchmark Kospi index.

Operating profit at the mobile-phone unit slumped to 2.74tn won from 6.43tn won a year earlier. The company fell into a tie with Apple as the biggest seller of smartphones in the December quarter, according to data from Strategy Analytics.

Samsung has projected record sales for the new high-end smartphones, which include the S6 Edge with a wraparound screen. Samsung will sell 46 million units of the S6 models this year, with the more-expensive curved model comprising half of shipments, according to estimates from Kevin Lee, an analyst at Korea Investment & Securities Co.

The phone is among the Samsung products featured in the new Avengers: Age of Ultron movie as part of a global partnership with Marvel Entertainment.

Demand for the curved screen prompted the company to accelerate production, people familiar with the matter have said. The company can make 5 million units a month, they said.

The S6 Edge with 64 gigabytes of memory costs the company $290.45, including materials and production, according to IHS. It retails for $799.99 at Verizon.

A comparable iPhone 6 Plus has a teardown cost of $240.05, it said.

“In 2015, continued growth is expected due to the growth of emerging smartphone markets, such as China and India,” Samsung said in an emailed statement. “However, increased competition in the middle- to low-end market and a possible decrease in demand due to the impact of foreign exchange rates in specific regions may present challenges.”

Apple this week posted a 33 per cent jump in profit in the quarter that ended in March, driven by strong demand for the larger iPhone 6 devices and sales growth in China. iPhone unit sales jumped 40 per cent to 61.2 million, topping analysts’ average prediction for 58.1 million, based on data compiled by Bloomberg.

business@thenational.ae

Follow The National's Business section on Twitter