Middle East property investors are targeting the UK’s commercial property sector after the Brexit vote, according to investment specialists from CBRE.

Ed Bradley, a senior director for investment properties in CBRE’s London capital markets team, said that the decline in prices as a result of the fall in the value of the pound, and the improvement in yields available for investors is leading to more interest in the UK from clients across the region.

“I would say that there is a new wave of capital coming out, in Abu Dhabi, of two groups who have not historically bought in London that are now bidding on assets. That has all been in the last two months,” he said. He also said that there was “a huge wall of capital coming out of Saudi that we have never previously seen”.

Chris Brett, the head of CBRE UK’s international capital markets arm, said that a tour that he and Mr Bradley took to meet Gulf clients last week found that attitudes towards UK and European investments were “much more positive than we expected”.

Mr Bradley pointed towards two post-Brexit deals that have been entered into by private Qatari buyers – the purchase of the 5 King William St office building and the Sony Headquarters building in London – as evidence that buyers from the region were taking advantage of the potential for improved returns in the UK.

“In the first half of the year, the market was looking fairly developed through the cycle. London was looking quite expensive on a relative basis,” he said. “Post-Brexit, sentiment has fallen and yields have shifted 25 to 50 basis points. Suddenly, a lot of Middle East investors see this as a big buying opportunity.”

A Brexit update published last month by JLL’s research arm said that the vote to leave the EU has had an immediate effect on property investment in the UK, with property valuations dropping. This meant that yields had started “moving out for the first time since the financial crisis”.

Meanwhile, a report by Mat Oakley of Savills also said that yields for primary and secondary offices should start to rise, but that this would depend on the amount of distressed property sales that take place.

It said talks it held before the referendum “indicated that there is a significant volume of opportunistic capital” that would target London from the Middle East, the US and Asia Pacific. “These investors all stated that they would be attracted to the income return of London offices if the yield were to rise 50 basis points.”

Mr Bradley said that demand from Saudi Arabia was coming from private family offices, and is typically looking at long-term, “10-year-plus” investments with secured tenants in place.

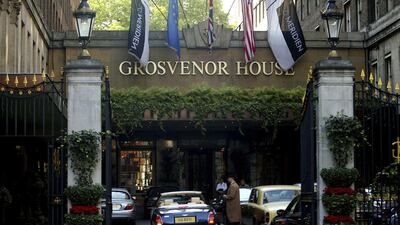

Saudi buyers were reported to be among a consortium of Middle East investors that has bid US$1.3 billion (Dh4.8bn) for London’s Grosvenor House hotel, as well as for majority stakes in New York’s Plaza and Dream Downtown hotels that are all being sold by India’s Sahara Group.

Mr Brett said that this is part of a growing trend among family-owned businesses across the Middle East and Asia, where second-generation family members who are more familiar with countries such as the UK and US seek to diversify family wealth outside its country of origin.

A report published last week by CBRE stated that Middle East investors spent $24bn on property outside the region last year. Accounting for disposals made, net purchases were at $16bn – up 190 per cent on the $5.5bn of net purchases made in 2014.

In the first half of this year, Middle East investors spent $10bn on international property.

mfahy@thenational.ae

Follow The National's Business section on Twitter