Property sales in Abu Dhabi and Dubai surged in the first quarter of this year compared with the same period a year ago as the UAE’s property market continues to rebound strongly from the coronavirus pandemic.

Abu Dhabi’s total sales transactions value for the three months to the end of March surged more than three times to Dh11.6 billion ($3.15 billion) compared to Dh3.6 billion for the same period last year, real estate listings website Property Finder said in its latest market watch report.

Off-plan sales transactions rose to 1,345 from 713 deals in the first quarter of last year, representing 66.4 per cent of the total transactions.

Masdar City emerged as one of the most searched areas in Abu Dhabi, with the average price for one, two and three-bedroom apartments at Dh745,000, Dh1.1 million and Dh1.8 million, respectively, the report found.

Al Reem Island, Yas Island, Al Raha Beach and Saadiyat Island were also preferred by buyers to own an apartment, according to Property Finder.

Asking prices for apartment as well as villas rose by seven per cent during the quarter amid high demand from buyers.

Yas Island, Saadiyat Island, Al Reef, Al Reem Island and Khalifa City were top picks for affordable luxury villas and town houses among home buyers, the latest data shows.

Rental prices also rose in the capital. Apartment rents were up seven per cent in the first quarter, while villa rents grew by two per cent.

Al Reem Island, Al Raha Beach, Khalifa City, Corniche Road and Al Khalidiya remained the preferred choices for apartment rentals in the quarter. Demand for renting a villa was high in Khalifa City, Mohammed Bin Zayed, Yas Island, Al Reef and Saadiyat Island.

“2022 ended on a good note with a heightened flow of foreign investment, and Q1 2023 ensured a sustained momentum — keeping up the trend,” Scott Bond, UAE country manager at Property Finder, said.

The UAE property market has continued to recover from the coronavirus pandemic on the back of government initiatives, higher oil prices and other measures to support the economy.

Property transactions in Dubai and Abu Dhabi surged last year amid higher demand from buyers.

Dubai property market's performance last year was described as "exceptional" by Crown Prince Sheikh Hamdan bin Mohammed, as the value of deals reached a new high of Dh528 billion, up 76.5 per cent annually.

The number of transactions, at 122,658, rose 44.7 per cent year on year, a Dubai Media Office statement said in January.

Property sales transactions also grew in Dubai, the commercial and tourism hub of the Middle East.

Dubai’s real estate sector performance reached a total transaction value of Dh157 billion in the first quarter of 2023, marking an 80 per cent annual increase, the Dubai Media Office said on Wednesday.

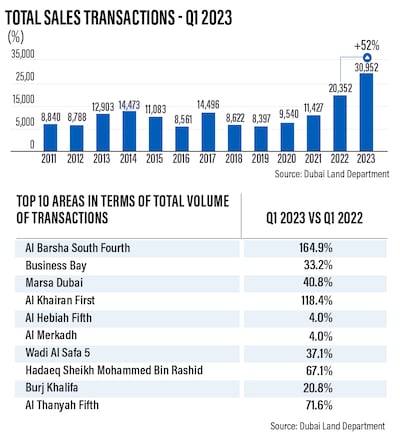

Meanwhile, the total registered sales in Dubai for the first quarter reached 30,952, up 52 per cent compared to the same period last year as off-plan sales almost doubled to 15,948 during the period, according to Property Finder.

The average asking price for apartments surged by 25 per cent annually, while villa prices rose 16 per cent in the three-month period.

Business Bay, Downtown Dubai, Dubai Marina, Jumeirah Village Circle and Palm Jumeirah were the top choices for owning an apartment in Dubai, while in the villa category, it was Dubai Hills Estate, Palm Jumeirah, Arabian Ranches, Damac Hills and Mohamed bin Rashed City.

Rental prices for apartments increased by 18 per cent and villa rents rose by about 29 per cent in Dubai.

Dubai Marina, Downtown Dubai, Jumeirah Village Circle, Business Bay and Jumeirah Lakes Towers remained the preferred choices for renting apartments.

Dubai Hills Estate, Damac Hills 2, Al Barsha, Jumeirah and Damac Hills emerged as renters' top choices for villas, with Damac Hills as the area with highest rental yields.

“For those who are actively home searching, UAE’s real estate sector has much more to offer now than ever, with significant returns and wider options across some of the city’s top areas and future-ready communities,” Mr Bond said.