The average price of ultra-luxury homes in Dubai rose by more than 27 per cent in the first quarter of the year compared with the previous quarter, as demand for prime property continued to pick up in the emirate amid a broader economic recovery.

The average price of a prime property in the emirate increased to Dh25.2 million ($6.86 million), with the total transactions in the segment reaching Dh14.7 billion during the three-month period, according to a report by Luxhabitat Sotheby’s, based on data from the Dubai Land Department.

The average price per square foot of a prime property rose 21 per cent to Dh3,373.

Jumeira Bay recorded the highest quarterly growth in sales volume of 220 per cent at Dh2.05 billion, followed by Al Barari with about 168 per cent sales growth at Dh926 million and Downtown Dubai with a 49 per cent sales increase amounting to Dh3.4 billion.

“Moving into the second quarter we see a continuation of high-volume residential transactions within the super prime luxury segment," Chris Whitehead, managing partner at Luxhabitat Sotheby’s International Realty, said.

"This continuity is primarily fuelled by the current lifestyle and wealth shifts being witnessed from incoming European buyers and a recent increased trend from institutional investors moving back into bricks and mortar asset classes," he said.

Prime turnkey properties continue to be in low supply, boosting demand, he added.

The latest data comes as the UAE's property market continues to boom after recovering from the coronavirus pandemic-induced slowdown on the back of government initiatives and a broader economic recovery.

Dubai has been ranked as the world’s fourth-most active market in the luxury residential segment, as sales of prime properties continued to pick up, Knight Frank said last month.

Last year, the emirate recorded the sale of 219 homes priced above $10 million, with the total value of the transactions reaching $3.8 billion. That ranks Dubai behind New York (244 sales), Los Angeles (225 sales) and London (223 sales).

In the first quarter of 2023, Dubai's luxury home sales hit Dh6 billion, with wealthy buyers snapping up 88 units valued at more than $10 million, Knight Frank said in another report last week.

The average price of a prime property in the first quarter, according to Luxhabitat Sotheby, was the highest in Jumeira Bay at Dh10,594 per square foot, despite only 22 units in the area being sold during the period.

Apartments in Jumeira Bay were sold on average at Dh91.2 million, with the most expensive ones being located at Bulgari Lighthouse and Bulgari Resorts and Residences.

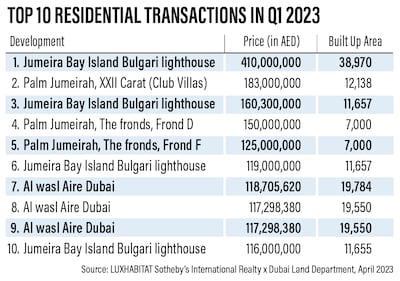

Four out of the top 10 most expensive transactions during the quarter were recorded in Jumeira Bay.

The price per square foot was second-highest in The Palm Jumeirah at Dh3,106, followed by Emirates Hills at Dh2,396.

In the luxury apartments segment, 1,584 units sold for Dh9.8 billion during the first three months of the year, accounting for 66 per cent of the overall prime market, the report said.

The top three areas for the segment were The Palm Jumeirah with Dh3.7 billion, Downtown Dubai with Dh3.4 billion and Jumeira Bay with Dh1.8 billion of sales.

The average cost of a prime apartment rose about 35 per cent quarter on quarter to Dh28.4 million. Off-plan sales accounted for 70 per cent of all apartments sold in the first quarter, Luxhabitat Sotheby’s said.

Meanwhile, 294 prime villas sold for Dh5.6 billion in the first quarter, with The Palm Jumeirah, Dubai Hills Estate and Al Barari emerging as the top three areas for the segment.

The average cost of a prime villa in the first quarter rose 37 per cent quarter on quarter to Dh36.8 million, the report found.