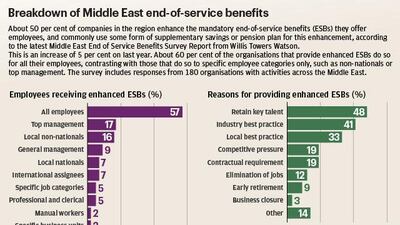

For the past seven years, Willis Towers Watson (WTW) has surveyed companies across the Middle East to assess trends in end of service benefit (ESB) payments in the region. The 2016 survey, which included responses from 180 organisations, has just been released and reveals that enhanced end of service benefits are on the rise with 49 per cent of companies offering them this year, as opposed to 45 per cent in 2015. Michael Brough, director and international benefits specialist at WTB in the Middle East, speaks about issues related to end of service benefit in the UAE, including why we should be concerned about the way companies manage their liabilities here.

Do companies have to legally provide ESBs in the UAE?

Yes, it is a requirement according to UAE Labour Law.

What percentage of companies provide enhanced ESBs?

According to the WTW Middle East ESB Survey 2016, out of the participants that supplied a response, 49 per cent advised that they enhance the ESB in some way [an increase from 45 per cent since 2015].

Has this changed in recent years in the UAE?

It has increased slightly over the last few years, but is generally stable.

What form do they take?

There are two. The first is a supplementary savings, or pension plan, usually defined contribution (DC); or secondly, through an enhancement to the Labour Law ESB formula, such as waiving the one-year waiting period; faster accumulation of days, eg rather than 21 days per year of service, it could be 30 days; a broader definition of salary used for ESB purposes, e.g. bonuses included or benefits in kind. Alternatively, they might ignore the cap on benefits that applies, which is two years of base salary; or offer better early leaver provisions.

What are the main issues relating to ESBs in the UAE?

The first is a lack of understanding by employees of how these are calculated and their entitlements. The second is sufficiency of the benefit – this is still small relative to other systems globally. Thirdly, few local companies fund the ESB and so there is a risk of employees not receiving a benefit should the company go bankrupt and run out of money. And lastly, a few companies are paying the ESB out every year, rather than at end of service and this may [result in] compliance issues.

Do many companies pay out on a regular basis, and why would they do that?

According to the latest WTW Middle East ESB Survey 2016, some 5 per cent of organisations indicate that they pay out on an ongoing basis. It is not obvious as to why companies might take this action, but if one were to speculate, it could be that companies feel they can avoid accounting for the liability, if they feel that ongoing payments have discharged the liability somehow.

How are companies managing their ESB liabilities?

Most companies continue to pay the liabilities out of the business as they fall due. There has been an increase in companies choosing to fund these either through separate external vehicles or internally within the business itself. This is likely to continue given it is viewed globally as good practice.

Should UAE employees be worried/concerned about the way companies are managing their ESB liabilities?

To some degree yes, the risk is that if a company does not fund the liability and then the company goes into administration/bankruptcy, then the ESB liabilities simply join the queue of creditors. Had the ESB been funded externally instead, through a trust vehicle, the ESB assets covering the liabilities would be safely set aside for the benefit of the employees. Many companies were ultimately unable to pay the ESB during the Global Credit crisis back in 2010, when many businesses failed in the UAE, because they did not set aside monies to cover the ESB promises.

pf@thenational.ae

Follow us on Twitter @TheNationalPF