In 2018, almost every asset class seemed like a loser. In 2019, however, it was the reverse, with opportunities abounding – and some of the biggest winners coming from unexpected corners of the market.

Last year featured geopolitical flare-ups such as an escalation in the US-China trade war and the UK’s Brexit drama, but markets were buoyed by factors like a dovish turn from central banks including the Federal Reserve. Add it all together and there was surprising market resilience despite periodic barrages of negative headlines.

“It’s been sort of fun trading this,” says Stephen Innes, chief Asia market strategist at AxiTrader. “Overall the trend has been up” and “just playing the reversions on all these massive hiccups has been very fruitful on virtually every cross asset right across the board. It’s been a good year on a number of fronts for everybody.”

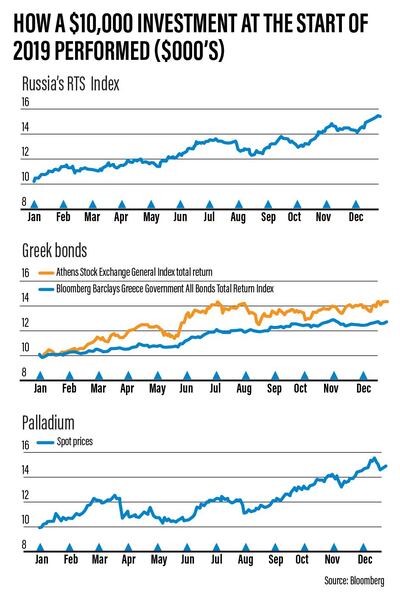

While most of the industry’s attention focused on the records in US stocks and global equity benchmarks, there were notable moves in other corners of the market as well. Here's what investing $10,000 in these asset classes at the start of 2019 would have delivered by December 31.

Russian revolution

In a year where the US imposed several rounds of fresh sanctions on Russia and Moscow was rocked by seven weeks of protests, the country’s equity market performed the best globally on a total-return basis in dollar terms, and its currency was the second-best worldwide. Stable oil prices allowed Elvira Nabiullina, governor of the Central Bank of Russia, to cut rates five times. That helped with the rebound from a sell-off in 2018 some saw as excessive.

Despite the political headwinds, Russian companies ended the year "generally speaking, in great shape,” says Fraser Lundie, head of credit at Hermes Investment Management. Many of them, such as commodity producer, benefited from stability in oil and foreign-exchange markets, ensuring “things have rarely been better,” he adds.

Performance: $10,000 invested in Russian equities on the country's RTS Index would have returned $15,400 by the end of 2019.

Greece lightning

Vying with Russia for the year’s best equity market performance was Greece, which started a turbulent decade with a financial crisis and an International Monetary Fund bailout – and ended it with a stunning rally for both stocks and bonds.

Reforms in the country started to pay off and the far-left Syriza party was ousted by the centre-right New Democracy in a July election. Easy money from the European Central Bank helped, allowing the country to borrow at negative interest rates during October, and its 10-year government bond saw the biggest rally year-to-date among 19 major markets tracked by Bloomberg News.

Performance: $10,000 invested in Greek bonds on the Athens Stock Exchange General Index would have delivered a total return of $14,400.

Ukraine’s moment

The world’s best-performing currency in 2019 out of more than 130 tracked by Bloomberg was the Ukrainian hryvnia, which saw a largely uninterrupted period of stable appreciation over the year. That marked a break with three years of price swings of around 10 per cent, which followed a collapse in the currency after the Russian invasion of Crimea and as separatists fought in the eastern part of the country. A package of market-friendly reforms, as part of an IMF programme, allowed the central bank to slash interest rates, helping to boost economic growth. The market value of the country’s currency rose faster than all others last year.

Performance: Changing $10,000 into Ukrainian hryvnia appreciated by $11,900 over the year.

Beyond Beyond Meat

In a bad year for start-ups, stocks tied to the fake meat craze stood out – particularly vegan food producer Beyond Meat. But it also generated a boom in Chinese companies looking to cash in on the momentum – with such frenzied buying around stocks tenuously linked to the trend that the Shenzhen stock exchange started to ask questions about producers of real meat, not the ersatz stuff.

One company, YanTai Shuangta Food, generated a total return of 175 per cent – and its fake-meat offerings are so far limited. That puts it within range of the 209 per cent return for Beyond Meat, which during the summer soared to almost 10 times its listing price of $25.

Performance: $10,000 invested in Beyond Meat would have secured a $30,600 return by the end of 2019.

Palladium hits a record

Palladium prices shot up about 51 per cent in 2019 and surpassed $2,000, making it the year’s best-performing precious metal.

“Palladium is a clear-cut situation of limited supply meeting increased demand from an automobile industry having to produce better and more environmentally friendly engines,” says Ole Hansen, head of commodity strategy at Saxo Bank. “With the main demand coming from this sector the price can potentially go much higher if supply remains tight.”

Performance: A $10,000 investment in Palladium at the start of 2019 would have been up more than $5,000 by the end of the year.