Deepening negative real yields in the US Treasury market are fuelling a frenetic rally in gold that is boosting the precious metal towards a record.

Bullion has gained 23 per cent this year and at $1,875 at 11.15 UAE time, it is about $50 from the all-time high of $1920.30 last seen in September 2011. With five-year Treasuries now yielding minus 1.16 per cent once the effects of inflation are stripped out, the lowest close in seven years, there is little reason to expect a slowdown in precious-metal buying as investors fret about the economic outlook, prospects for further outbreaks of Covid-19 and the impact of central-bank bond buying.

“Gold is a superior form of purchasing power protection and as real rates dive significantly below zero here, gold is relatively more attractive as a hedge,” said Peter Grosskopf, chief executive at Sprott, a precious metals specialist with about $8 billion (Dh29.38bn) under management.

With investors looking for safe-haven assets that won’t lose value, they are pouring record amounts into precious-metal exchange-traded funds. So far this year, ETFs have increased their gold holdings by 28 per cent to more than 105 million ounces, according to data compiled by Bloomberg, taking the total value to $195bn.

Real yields are also driving investors away from the US dollar, which is currently trading near the lowest since March against a basket of currencies, Makoto Noji, chief foreign-exchange and bonds strategist for SMBC Nikko Securities in Tokyo, wrote in a research note.

Silver has also posted a spectacular rally as the forces driving gold spill into other precious metals. The spot price has gained almost 20 per cent in the past week to about $23 an ounce, the highest in almost seven years.

The rally may become self-perpetuating as the publicity gained by higher prices draws more people to invest in precious-metals funds.

“The combination of low-to-negative government bond yields plus a weakening US dollar and, most importantly, massive central bank accommodation, supports financial demand,” said Stephane Monier, chief investment officer at Geneva-based Banque Lombard Odier & CIE. “This relationship between gold and real yields has held for the last decade and recent central bank interventions have reinforced the case for holding gold as a portfolio diversification tool.”

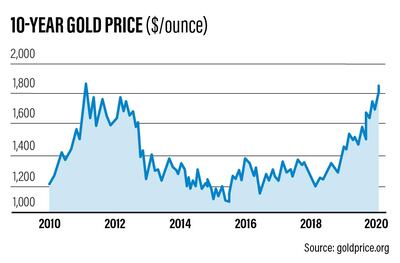

Gold first breached $1,000 an ounce during the global financial crisis in 2008 before reaching a record $1,921.17 an ounce in September 2011. This year’s rally puts it on course for its biggest annual gain in a decade.

“The damage inflicted to the dollar as a result of fiscal spending and falling real interest rate due to monetary easing provide bullish factors for gold,” said Yuichi Ikemizu, head of the Japan Bullion Market Association. “As long as this environment continues, gold will continue to rise.”