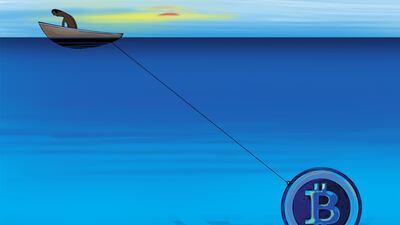

I am from Turkey and used to work in the restaurant business in Abu Dhabi earning Dh6,000 a month but I lost my job in February after having an argument with my manager. By then I had taken out a Dh55,000 loan because I wanted to set up an ice cream and sweet business. But it all went wrong last December when I started trading Bitcoin with the loan amount. I was buying and selling the cryptocurrency but ended up losing it all by February. I lost the Dh55,000 plus Dh10,000 I had in savings.

My outstanding debts are:

Loan: Dh49,000

Credit card: Dh18,900

Now I am surviving with part-time jobs, helping friends that run businesses here. I have received one job offer but it is only for Dh2,000. My monthly expenses are: Dh1,100 for rent, Dh200 for my phone, Dh600 for food and general expenses and Dh200 for transportation.

Now I am just about managing to make the minimum payments on my loan and credit card but it has been a struggle since May. What happens if I stop paying my credit card bill? I gave my credit card and loan providers security cheques, so if my cheque bounces and they file a case with the police – will I pay a fine? If I pay that fine and then the case is closed, what happens if I still cannot make payments? FE, Abu Dhabi

Debt panellist 1: Steve Cronin, founder of DeadSimpleSaving.com, which helps residents invest their own money

You have learnt a Dh65,000 lesson here – do not gamble your savings, and certainly not someone else’s money (the bank’s), on risky investments. I’m sure you felt flush with cash when the money first hit your account and dreamt of doubling or tripling it. You should never invest more than 10 per cent of your net worth (what you own minus what you owe to others) in risky investments such as Bitcoin. The core of your investment portfolio needs to be solid: cash, diversified stock funds, bond funds, property. As your net worth in December was minus Dh45,000 (your savings minus your loan), you should not have invested in Bitcoin at all.

It’s clear also that you should have not tried to set up an ice cream business, because your heart wasn’t really in it. If you were passionate about the business, you would never have wasted the money.

You need to get back on a more stable financial footing as a priority. To do this, you must carry on paying the loan off and pay off the credit card debt as fast as possible. Even if you only make the minimum payment on your card, the high interest rate (probably 40 per cent plus per year) will make your debt grow faster than you can pay it off.

If a police case is filed for you bouncing your cheque, you could go to jail. Paying any kind of fine would not let you off your payment. It is not a viable option to fix your situation.

Keep trying to find part-time and full-time work, in whatever industry, through LinkedIn, Upwork, Turkish business networks, restaurant networks and friends. Without a salary of more than Dh8,000, you will not be able to get a consolidation loan to reduce the interest on your credit card. If you have any friends or family who will lend you, at a low interest rate, the money to pay off your credit card balance, this will help you a lot – then you can focus fully on your loan.

If you are making more from helping your friends than the Dh2,000 offered by a company, then hold out for a better offer. If not, take the job as you can still look for a better job over time. Be aware you cannot stay in the UAE for long without a job and visa.

___________

Read more:

The Debt Panel: 'I have owed money in the UAE for 20 years'

The Debt Panel: 'I paid back my missed payments, so why does the bank not recognise this?'

The Debt Panel: 'I have a new job in Saudi Arabia — can I repay my UAE loans from there?'

The Debt Panel: 'After two redundancies, 70% of my Dh22,000 salary goes to the banks'

'I signed up for three credit cards because my income did not match my expenses'

____________

Debt panellist 2: Shaker Zainal, head of retail banking at CBI

Your first priority should be to bring your debts under control, as it was before, to avoid any further complication with the bank.

Since you have a source of income, approach the bank and request them to restructure your loan. Even if it is freelance income, if you can document this, the bank will consider it. Of course, compared to a regular income, such as a salary, the chances of success is lower, but it’s still worth having a discussion with the bank, as the other alternative for the bank is potentially a non-performing loan.

The bank can then either increase the loan tenure or partially reduce your interest rate, which will allow you to reduce your monthly instalment payments.

Please be mindful that your bank reserves the right to go ahead and file a civil suit against you for the amount you owe. If you pay a fine to the police in the event the bank files a case, your case may be released from the police, however you would still continue to be liable to pay the dues owed. Hence, I suggest immediately discussing your financial situation with the bank, as they will most likely help you with several options in terms of settlement or restructuring of your liabilities.

If you have assets back in your home country, you may also consider selling them to provide you with some relief in your current financial distress, as I think your priority should be to retain your income in the UAE to get your financial situation under control again.

___________

Read more:

Start-up will help UAE residents borrow money they can afford to repay

The Debt Panel: Single mother of four is being hounded by debt collectors over Dh43,000

A nine-step guide to help you renegotiate bank debts in the UAE

How an Abu Dhabi resident took three UAE banks to court and cleared Dh700,000 debt

It is possible to restructure debt directly with UAE banks, a Sharjah resident reveals how

__________

Debt panellist 3: Keren Bobker, an independent financial adviser with Holborn Assets

Using borrowed money to trade in something as volatile, risky and unregulated as cryptocurrencies, is plain foolish. It was borrowed for a specific purpose, so why would you use if for something as risky as this? And then to use your savings as well? Everyone should have savings to fall back on if they are made redundant but wasting it in this way means you now have issues meeting your personal liabilities.

You say you are making the minimum payments on your credit card and loan and you need to continue doing that. Failing to make debt repayments in the UAE is a criminal issue with serious consequences. If you miss one scheduled repayment you can expect to receive telephone calls to ask when the payments will be made. If you miss three payments, the banks have the right to register a police case against you. That can potentially lead to imprisonment and also cause complications in obtaining a new employment visa as well as a travel ban preventing you from leaving the UAE.

You gave the bank a security cheque when you took out the loan so if you do default the bank could try and encash this. However, the bank should not have taken a cheque from you for this reason. Per Central Bank of the UAE regulations regarding bank loans issued in 2011, which do not appear to have been rescinded, banks should not request security cheques. Article 15 of this states: “Banks and finance companies are prohibited from taking blank cheques for granting loans or overdraft facilities, or for issuing credit cards.”

Whether a cheque bounces or not, missing payments remains an issue and the bank can still register a police case. A cheque bouncing and a fine being paid does not mean that a debt is paid off or a case is closed when a person has defaulted. You are still liable to repay any money that you have borrowed.

You have little option but to find a job with a salary that will cover your basic expenses as you have to repay what you chose to borrow.

The Debt Panel is a weekly column to help readers tackle their debts more effectively. If you have a question for the panel, write to pf@thenational.ae