Financial services firms can capture more than $700 billion (Dh2.5 trillion) in additional annual revenue by serving women better — an estimate greater than the annual proceeds of the world’s largest financial institutions, according to global management consultancy Oliver Wyman.

To tap the unrecognised revenue, companies must understand women's needs and create wealth products and services tailored to those requirements, rather than treat the gender as a single customer segment, according to the consultancy's Women in Financial Services 2020 survey. Current products are not consistently designed for women and those that appear gender-neutral are slanted towards male customers, the report found.

“Women are arguably the single largest underserved group of customers in financial services. Despite playing increasingly influential roles as buyers of financial services, their needs are not consistently being met,” said Jessica Clempner, principal and lead author of the report. “Firms are leaving money on the table by not listening to and understanding their women customers.”

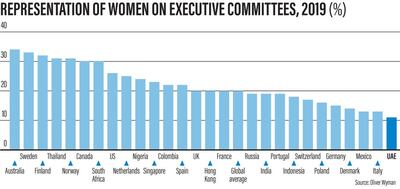

The proportion of women on executive committees has increased to 20 per cent in 2019 from 16 per cent globally in 2016, the study said, with the percentage of women on boards reaching 23 per cent, an increase of 4 per cent since in 2016.

Gender balance in the workplace is a global issue with narrowing the gender pay gap, combating discrimination and rolling out flexible working policies key issues. In the UK, for example, April 2017 regulations require companies with more than 250 employees to report their gender pay gap figures.

Two years of reporting has seen the gap shrink slightly to 9.6 per cent from 9.7 per cent, but almost eight in 10 companies still pay their male employees more, according to UK government figures published in April.

However, there is still work to do globally with 19 per cent of financial services firms' executive committees still made up entirely of men along with 15 per cent of boards. Chief executive and chair representation figures also remain far too low, at 6 per cent and 9 per cent respectively, said Oliver Wyman.

It means as well as creating suitable products and services for women, firms must also take a broad approach towards gender diversity to ensure “meaningful progress” in the workplace, the report found, with supervisors and shareholders increasingly applying pressure on firms to drive better returns through diversity and inclusion.

In the UAE, for example, the government made gender balance a national priority. Last year the UAE cabinet endorsed a bill ensuring equal pay for men and women. Currently in 46th place in the United Nations Development Programme’s Gender Inequality Index, the UAE aims to be one of the world’s top 25 countries for gender equality through its Vision 2021.

“Here in the Middle East, we are seeing progress, but there is a lot more that can be done to ensure steps are being taken by companies to improve regional diversity and inclusion,” said Jeff Youssef, partner, public sector, Oliver Wyman.

“Private and government sectors must come together to deliver the next wave of change by applying frameworks that drive a much broader approach to gender balance. We know that when gender balance is at the core of a firm’s business strategy there is a far greater chance of delivering better business outcomes.”

Australia leads the way with 38 per cent of executive committees made up of women, followed by Sweden at 33 per cent and Finland at 32 per cent. The UAE featured high on the list compared to other Gulf countries with a percentage of 11 per cent. The US has only 26 per cent female representation on executive committees, while the UK and Hong Kong have 20 per cent.