A steady rise in the number of family offices calling the UAE home and the influx of high-net-worth individuals to the country in the past few years has not only attracted asset managers and investment companies from across the globe, it has also given rise to peer networks for the ultra-wealthy.

One such network, which has recently opened a chapter in Dubai, is Tiger 21, a fraternity of ultra-successful professionals who work together to elevate and develop each other, personally and professionally.

Members of the group, which was set up in 1999 by American entrepreneur, philanthropist and political activist, Michael Sonnenfeldt, exchange advice on wealth preservation, inheritance, investments, legacy building and philanthropy.

Tiger 21 has 1,600 members, largely first-generation wealth creators, who manage $200 billion in aggregate assets. Most of the members are entrepreneurs who have sold their businesses and are now looking to preserve wealth. In September, the group opened its first chapters in Dubai and Singapore after growing interest from its members.

“Dubai has only continued its rather dramatic ascendance in terms of being a place that the ultra-high-net-worth community wants to call home, and where family offices want to establish themselves,” says Timothy Daniels, president and chief executive of Tiger 21.

“Demand from our members in other cities pulls us into new markets like Dubai and Singapore. [The] increased number of HNWIs coming to Dubai made them want to connect here.”

The UAE established itself as the leading destination for high-net-worth individuals, or HNWIs, globally in 2024, attracting more than 6,700 millionaires, according to British investment migration consultancy Henley & Partners.

Dubai hosts 15 billionaires, 212 centi-millionaires – individuals with net worth of investable assets of $100 million or more – and 72,273 millionaires, according to the Brics Wealth Report released last year by Henley & Partners.

Knight Frank’s Wealth Report 2024 noted that the UAE enjoyed an 18.1 per cent increase in ultra-high-net-worth individuals, or UHNWIs, ahead of Saudi Arabia’s 10.4 per cent. HNWIs have liquid investable wealth of $1 million or more. UHNWIs are those with a net worth of at least $30 million, according to Knight Frank.

Membership criteria

The Tiger21 community has two primary goals: wealth preservation and how to deal with family issues such as legacy building, inheritance and care of elderly parents. The network aims to create a safe place for members, who include private space investor Dylan Taylor, serial entrepreneur Martin Hermann, venture capitalist Howard Morgan and blockchain expert Perianne Boring, to learn from each other.

Membership of Tiger 21 is referral-based with an extensive background check, says Vijay Tirathrai, chair of one of the network's Dubai chapters. A chair curates the group, facilitates and nurtures it. “If I'm a member, I would view my group as a personal board of advisers,” he says.

There are five Cs for member selection: character, contribution (in terms of their experiences), capacity (time and ability to participate in meetings), conditions (confidentiality and no solicitation) and capital (a minimum $20 million in terms of net worth or investable assets).

There is a membership fee of Dh121,000 ($32,947) annually plus a one-time initiation fee of Dh18,000, according to Tiger 21’s website.

Mr Daniels says besides the two existing chapters in Dubai, two more are being considered in the emirate. Members will also have access to Tiger 21 groups globally through an app. They can travel to cities where Tiger 21 has a presence, such as London, Singapore and Boston, and participate in meetings as an equal member to “help broaden horizons”.

“For instance, if an Emirati member is considering an investment opportunity in Singapore, or their child is doing an internship in Zurich, or they want to find out the best restaurant in Miami, they can leverage the global network,” he adds.

“We do not offer advice to our members. All we do is create the conditions for them to be able to come together and talk about the complex matters that oftentimes accompany their wealth. Trusted relationships are oftentimes hard to develop. The counsel that you get to avoid making an investment that ultimately would have led to a multi-million-dollar loss is invaluable.”

Dubai chair Mr Tirathrai says that markets such as Mumbai, Singapore and Switzerland tend to have a significant number of long-established businesses and a rich history of family businesses. In comparison, Dubai is a very young city, but offers diversity, specifically around industry types, ethnicity, culture and the complexities that HNWIs face in dealing with transborder business and transactions.

“Our group offers a safe space, bounded by confidentiality, to support difficult conversations, allowing members to be vulnerable and knowing that they will get clear reflections from peers who have been through those journeys themselves,” he adds.

Wealth preservation

Mohamad El-Hage, chair of one of the Tiger 21 groups in Dubai, says members are “incredibly well-established individuals”, and with wealth comes blessings, but also responsibilities. Members discuss issues related to the next generation, elderly parents, philanthropy, wellness, selecting asset managers and managing asset classes. Real estate opportunities come up frequently in meetings, as well as crypto and Bitcoin, he adds.

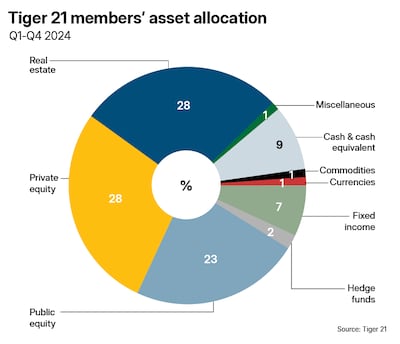

“Members in young groups like Dubai join with a purpose of becoming better investors and diversifying their assets. You may have individuals who are very heavily invested in real estate, private equity or direct investments. Asset allocation is of interest to members in a young group like Dubai,” says Mr El-Hage.

“The majority of Tiger 21 members in Dubai are entrepreneurs that have created their own businesses, so it keeps the conversation rich in terms of their experiences and perspectives on wealth.”

Members meet once a month in a private setting in hotels, Mr El-Hage says. They are recommended to attend 11 meetings annually and these run from September to July.

There are 12 to 15 members to a group, aged from their early thirties to about 60, according to Mr Tirathrai. They come from a range of professional backgrounds and may have created wealth in different ways.

“In a typical group of 12, you'll have very diverse asset allocation, almost to the extent of polar opposites. In the Middle East, there is a propensity to invest in real estate, because it’s more tangible,” he says.

“But on a global level, there’s a trend towards private equity, and more increasingly to private capital markets. Wealth owners prefer to manage their wealth more directly, as opposed to giving to fund managers, and also to go into sectors that they understand more.”

Mr Daniels says cryptocurrencies account for between 1 per cent and 3 per cent, or about $6 billion, of members’ portfolios. “I think that will rise rather significantly in the years to come under a crypto-friendly administration in the US,” he reckons.

Mr Tirathrai says members are required to make an investment portfolio defence once a year. This is followed by feedback from the peer group.

Tiger 21 is preparing to launch groups in the Indian cities of Mumbai and Bengaluru, and also in Milan in the first half of this year. “The tax law changes going into effect in the UK are causing many wealthy families to perhaps consider relocating to Italy, and Milan in particular, as the city has created a welcoming environment from a tax perspective,” Mr Daniels says.