Stock markets on Wall Street and in London were off to a solid start in the first full week of trading in 2026, driven by a tepid US jobs report that pointed to the possibility of more interest rate cuts from the Federal Reserve.

The US Labour Department said on Friday that the world's top economy added about 50,000 jobs in December, lower than analyst projections, although the unemployment rate decreased to a better than expected 4.4 per cent.

The central bank, led by chairman Jerome Powell, has continued to take a cautious tone on interest rates after cutting them three consecutive times in 2025 amid pressure from US President Donald Trump. Analysts are betting on at least one or two rate cuts in 2026.

The S&P 500 closed 0.65 higher, hitting another record as it continues its march towards the key 7,000-point level and bringing its gains in the first five days of the year to about 1.1 per cent.

That early headstart is a bullish signal for the full year, said Alec Young, chief investment strategist at US research firm MoneyFlows.

"Since 1950, the S&P averages a 16 per cent annual gain when it's up in the first five days of the year versus just 3 per cent when it's down," he said.

"When the first five days have been positive, the full year has been up 86 per cent of the time. The January barometer is no joke."

The Dow Jones Industrial Average added 0.5 per cent to close in on the 50,000-point mark. The tech-rich Nasdaq Composite gained 0.8 per cent.

The market was lifted by chipmakers, most notably Intel, which soared 11 per cent after chief executive Lip-Bu Tan met US President Donald Trump.

"Markets have started the year positively with global equities hitting record highs, largely ignoring geopolitical risk and focusing on the economic fundamentals and Fed rate path," analysts at London-based financial services firm Arbuthnot Latham said.

"Key market drivers will again be the fundamentals of inflation, growth, and jobs, as well as geopolitical developments, tariffs, and US-China relations and economic competition."

In Europe, London's FTSE 100 settled at a record high, also buoyed by the US jobs report and Fed rate cut expectations.

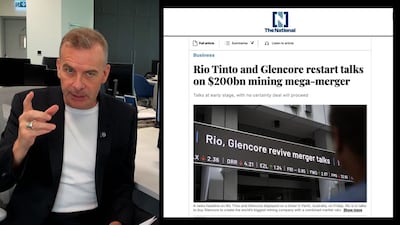

Mining major Glencore leapt nearly 10 per cent on reports that it is in discussions with Rio Tinto for a merger that would create the world's biggest mining group valued at an estimated $207 billion.

London’s stock market staged a rebound with a late spurt in 2025, driving the strongest year for listings since 2021, data had shown.

Frankfurt's DAX added 0.4 per cent after recording a new high, while Paris's CAC 40 jumped up 1.4 per cent.

Earlier in Asia, ahead of the US jobs report, Tokyo's Nikkei 225 settled 1.6 higher, lifted by retail and car manufacturer stocks.

Markets rose in China, the world's second largest economy, including in Hong Kong, on the back of more positive economic sentiment. The Shanghai gauge added nearly 1 per cent to close at its highest level in a decade, while the Hang Seng Index gained 0.3 per cent.

In commodities, oil prices jumped by more than 2 per cent on Friday and posted a third consecutive weekly gain as tension in major Opec members Venezuela and Iran, and Mr Trump's threats to impose tariffs of 500 per cent on countries that buy Russian oil, stoked supply concerns.

Brent gained 2.18 per cent to settle at $63.34 a barrel, while West Texas Intermediate added 2.35 per cent to close at $59.12.

Gold, meanwhile, posted a weekly gain over economic uncertainties and the weak US jobs report. The precious metal, which hit another high two weeks ago, settled about 1.3 per cent higher at $4,509.20 an ounce.