There is likely to be a “strong pipeline” of sustainable bonds coming from the Middle East this year, according to S&P Global Ratings, as the region continues to focus on the green economy.

The wider Europe, Middle East and Africa region accounted for the biggest share of green, social, sustainable and sustainability-linked bonds (GSSSB) worldwide in 2022, at 48 per cent, the ratings agency said in a report on Wednesday.

“Green bonds in the use-of-proceeds category will continue to lead issuance in Emea region in 2023, in our view,” the report said.

“This should be driven by the focus on credible net zero plans by issuers, the European Central Bank’s intent to green its bond-buying programme, and the implementation of the EU Taxonomy and EU green bond standards.”

Issuers are also increasingly looking to finance projects related to biodiversity enhancement and preservation, it added.

The market for green and sustainable bonds and sukuk in GCC economies set a record in 2022 amid increased participation from banks and government-related entities, according to data from Bloomberg’s Capital Markets League Tables.

Total GCC green and sustainable bond and sukuk issuances last year reached $8.5 billion from 15 deals, compared with $605 million from six deals in 2021.

Saudi Arabia was the leading issuer within the region, accounting for more than half of the total volume, with the UAE accounting for the remaining issue volume, it said.

In October, Saudi Arabia’s sovereign wealth fund, the Public Investment Fund, listed its debut $3 billion green bond on the London Stock Exchange. The transaction was more than eight times oversubscribed, with orders exceeding $24 billion, the state-run Saudi Press Agency reported at the time.

In November, Dubai Islamic Bank, the UAE’s biggest Sharia-compliant lender by assets, raised $750 million through the sale of its debut sustainable sukuk.

In January last year, Abu Dhabi National Energy Company, better known as Taqa, together with Emirates Water and Electricity Company, also raised $700.8 million through its first green bond.

Meanwhile, Abu Dhabi’s clean energy company Masdar plans to raise money through the issuance of a green bond this year, the company's chief executive said last month.

The size of the planned bond was not disclosed.

The Arab Petroleum Investments Corporation (Apicorp), a Saudi Arabia-based multilateral lender owned by the 10 members of the Organisation of Arab Petroleum Exporting Countries, has allocated $335 million to fund green projects after it raised $750 million through a green bond in 2021, it said on Wednesday.

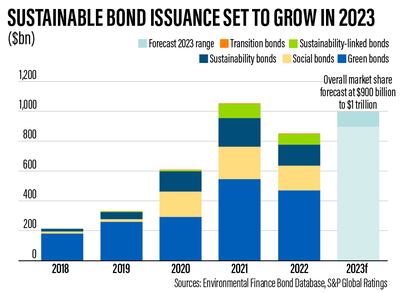

Globally, GSSSB issuance will return to growth this year, reaching $900 billion to $1 trillion, nearing the record $1.06 trillion it reached in 2021 after “contractionary monetary policy and macroeconomic uncertainty” pulled down overall bond issuance last year, S&P said.

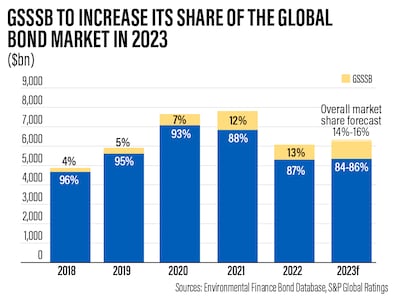

While total global bond issuance is anticipated to only grow moderately this year, faster growth for GSSSB issuance will lead to a larger market share for this asset class across all regions and sectors.

“We believe GSSSB issuance from non-financial corporates, financial services, and the US and international public finance sectors is likely to comprise 14 per cent to 16 per cent of all bond issuance in 2023,” S&P said.

Three factors could drive growth or drag it down, including policy initiatives, levels of investment in climate adaptation and resilience, and the ability of issuers to address concerns about the credibility of certain types of GSSSB debt, the report said.

“Over the next five years, regulatory initiatives could be a key driver of whether the GSSSB market grows,” it said.

“National directives on electric vehicles or national building standards, for example, could provide direction or signals for further sustainable finance flows.

“The content of initiatives could inform corporate and government decisions on financing research and development, infrastructure projects, and plants and equipment.”

Cop27 in November emphasised the need for more investment in adaptation and resilience to the physical risks of climate change, which could boost the issuance of green and sustainability use-of-proceeds bonds.

“Green bonds will likely continue to dominate,” the report said.

“However, we expect to see sustainability bonds become more prevalent.

“Meanwhile, sustainability-linked bonds are at an inflection point.

“Scepticism and questions around the credibility of the asset class’s ability to achieve meaningful sustainability targets are increasing, weighing on the minds of investors and issuers.”