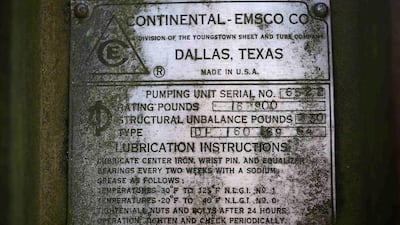

Sustainably high oil prices have lured small oil explorers back to Alsace, the cradle of the French oil exploration industry that gave birth to corporate giants such as Schlumberger.

In pictures: Oil exploration returns to France’s Alsace region

Most popular today