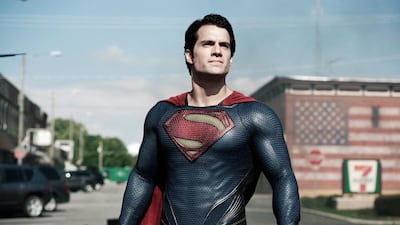

Those holding multiple seats on company boards are often called the supermen and women of the business world.

But given the dizzyingly long CVs boasted by some, questions arise as to whether these “superheroes” are more like villains when it comes to effective corporate governance.

The UAE’s new 2015 commercial companies law says that individuals should not hold more than five board positions, two chairmanships or one managing director role.

Yet there is evidence that some UAE business people have far exceeded these limits, with some holding down a dozen or more positions.

Andrew Kakabadse, the professor of governance and leadership at Henley Business School in the UK, says some individuals in the UAE have held up to 29 positions concurrently, citing his own research.

Prof Kakabadse – who until last year held a government consulting job in Abu Dhabi, although was not resident in the UAE – says that the maximum number of non-executive board seats held by one individual should be three to four, or two chairmanships.

But some people hold many more than that – leading to woefully ineffective boards, said Prof Kakabadse.

“About 90 to 95 per cent of boards across the world … are seen by management and other stakeholders as not providing much value. One of the reasons is that board directors are holding too many positions,” he said. “These directors turn up to meetings to fundamentally rubber stamp, because they have no way of knowing the value of the data put in front of them.

“Because they don’t know much about the company, they don’t know how to ask the difficult question. Because they don’t know what the difficult question is.

“So what do you have? You have completely worthless boards.”

There are of course exceptions to this, and many examples of highly effective boards. Some companies require board members to visit different locations and ask staff difficult questions, to help encourage “stewardship” and the better guidance of the company.

And there are moves to address the issue of multiple directorships globally, Prof Kakabadse said. In London, for example, there is now more “scrutiny placed on how many board positions” are held by individuals, he said.

“You are beginning to see [globally] a growing respect for the need to have high-performing board directors,” he said. “The idea that you need some sort of superman to deal with all these issues is simply not true. You simply have to have somebody who fundamentally understands the company and they can step back and say, ‘now let me think through what all you guys are doing, and give you my opinion’.”

__________

Governance in focus

■ Management: Know your requirements before you set up a board

■ Teamwork: The board is a team, and that's how it must work

■ Workplace Doctor: Abu Dhabi firm failing to maintain corporate governance principles

■ Awareness: UAE companies increasingly aware of gains to be had

■ AGMs: When annual meetings become forums for confrontation

■ Virtual AGMs: When the AGM is everything but personal

■ Editor's letter: An issue important to our well-being

■ History: Be good, because investors are watching more closely

■ Poll: Corporate governance in the UAE – have your say

■ Analysis: A good board brings right mix of knowledge and culture

■ Gender equality: 30% Club GCC chapter to boost women numbers on company boards

__________

Prof Kakabadse said that the issue of people holding multiple board positions is worst in countries such as South Africa – where he has found evidence of people holding as many as 45 board positions concurrently – along with the UAE and United States. The problem in the UAE, he said, was due to “inner relationships and family relationships”. But Prof Kakabadse said he also saw a willingness to improve the situation in the country.

“When I went to the various institutes of the UAE – banks, funds, also the governance institutes of the UAE, the entrepreneurship schools and so on – there is a keen interest to improve,” he said. “In that sense the UAE stood out a little bit above many other Middle Eastern countries.”

Not all are so critical of those who hold multiple board positions.

Alvaro Abella, a managing partner at the venture capital firm Beco Capital in Dubai, said that it all depends on the individual involved. He pointed to the likes of Elon Musk, who is said to work up to 100 hours a week – and has been highly effective as a businessman.

“On average as long as you are able to maintain the focus, and are able to pull your weight in terms of what you’re expected to do working for the board, it’s up to the individual really,” said Mr Abella.

Fause Ersheid, a senior corporate governance analyst and researcher at the Abu Dhabi Centre for Corporate Governance, pointed to the relatively small population of Emiratis as one justification for some holding multiple positions.

“It is only natural to allow experienced and qualified directors to hold more than one directorial position,” he said.

There are, in fact, some advantages to individuals serving on more than one board, he said.

“[These] include diversifying their relative experience, having access to high-profile directors, which in turn raise the profile of the company seeking to hire them, and filling the experience shortage gap,” said Mr Ersheid.

But he acknowledged there are drawbacks, too.

“Board members might not have the … time to properly prepare for board meetings, so their potential value added to the company and their effective contribution to the overall decision-making process will be limited,” he said.

One “superman” who knows all about the limits of time is Kurt April, whose numerous academic roles include positions at the University of Cape Town and Ashridge Executive Education in the UK.

The South African juggles 11 jobs, including his academic work, seats on four boards, running his own consulting firm as well as a BMW dealership.

Prof April was happy with this arrangement until about 18 months ago, when he suffered a panic attack in a hotel in Australia, induced, he says, by a lack of sleep.

“I was acting like I was a superman,” said Prof April. “But the downside was that I was living on three hours’ sleep.”

He has studied the phenomenon of those holding down multiple jobs, as well as the health implications of this.

“A lot of the executives are living on antidepressants; testosterone levels are down. They’re just hanging on, basically,” he said. “They’ve run their bodies and minds ragged, just keeping up. And so this notion of the superman is actually coming back to bite them.”

The academic believes that an individual should hold no more than three board positions.

He pointed to more stringent corporate governance regulation globally, such as rules holding board members personally accountable for business failures, as making people think twice before taking lots of positions.

“If you go back 10 or 15 years, people used to sit on, ridiculously, 13 boards. I’m not sure how much value one could add on 13, but people did it. But now that you get pulled into court personally … some people have narrowed down the amount of boards they sit on.”

For Prof April personally, it was the health pressures of constant travel and getting very little sleep that forced him to reprioritise his working life.

“That has caught up with me now,” he said. “I certainly can’t live on three hours’ sleep any more, I did that for 20 years. Hence the panic attack 18 months ago.”

So there may still be corporate supermen out there – but their superpowers can come at a cost.

business@thenational.ae

Follow The National's Business section on Twitter