In recent weeks, India's national capital New Delhi has been choked by a thick blanket of smog, which has kept many people indoors and resulted in grave health warnings being issued.

One of the Indian government's plans to help alleviate pollution, which is a major problem in a number of cities in the country, is to use more natural gas in the energy mix as an alternative to coal and oil.

This is also part of a strategy to ensure the country's energy security and meet the demands of its fast-growing economy.

It is not proving to be an easy process, however, partly due to the fact that coal is a much cheaper means of generating power, while other obstacles include infrastructure constraints.

“India has an opportunity to significantly grow its gas market,” says Rajesh Shah, the chief executive of Sterling & Wilson Co-gen Solutions, a power solutions company. “Given India’s high urban air pollution levels, it's imperative.”

The prime minister Narendra Modi this month reiterated a target to increase the use of natural gas by 2.5 times by 2030, to 15 per cent of India's energy mix from 6.5 per cent.

But despite New Delhi having previously stated ambitions to increase the share of natural gas in the country’s primary energy mix, it has lagged behind the growth of other energy sources and its share actually declined from 10 per cent in 2009. The use of gas in India has risen in recent years, though.

“For a fast-developing country like India which is already dealing with significant air quality issues, the idea to increase the consumption of gas in its energy mix is a no-brainer,” says Rahul Agarwal, the director at Wealth Discovery, a firm offering services including commodity and currency broking, research and wealth management, headquartered in New Delhi. “The stiff competition that gas faces vis-à-vis coal is perhaps the biggest reason that gas usage has been sluggish and, in addition weak domestic production, is another key reason for gas being a laggard in the energy mix.”

Coal comes in at about a quarter of the price of imported gas for power generation.

He says that “a lower gas price regime, increase in domestic production, lower gas import prices and a significant increase in the [amount] of gas-based infrastructure remain the key ingredients for India to be able to meet its stated goal”.

Expanding the use of gas is particularly important given the rising appetite for energy in a country of more than 1.3 billion, which is the world's fastest-growing major economy and where rapid urbanisation is taking place.

The vast majority of India’s power needs today are met by coal-fuelled power plants. But there are still about 300 million people in the country who do not have access to electricity, according to the World Bank.

Meanwhile, the country is under pressure from the international community to reduce its carbon emissions and a switch to gas could help in this process. Under the Paris climate change agreement, India has pledged to reduce carbon emissions intensity - a measure of carbon emissions per unit of economic activity or GDP - of its economy by up to 35 per cent by 2030.

Carbon emissions from natural gas are about 50 per cent lower than coal and 30 per cent lower than oil.

The International Energy Agency in its latest world energy outlook report projects that India's use of natural gas will increase by 4.9 per cent a year until 2040, propelled by power and industrial demand. But its forecast is that gas will still only make up less than 10 per cent of the energy mix in the country by that time.

Adnoc to pick more partners for Ghasha ultra-sour gas concession

Vivek Jain, the director at India Ratings and Research, which is part of Fitch Group, says that “there has been a certain amount of success” in the government's aims because gas consumption is rising in India.

About 50 per cent of natural gas is imported, with most of this coming from Qatar, he says. But gas production within India has not kept pace with the growing demand.

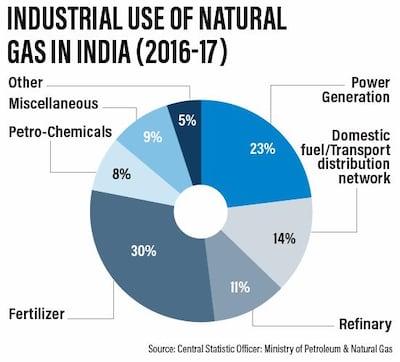

In India, gas is primarily used for fertilisers, followed by power generation, domestic fuel - largely for cooking - transport and petrochemicals.

“Over the next few years, the kind of infrastructure we are setting up on the gas side, be it the LNG [liquefied natural gas] terminals or the pipelines that are coming, definitely there's a strong case that the gas will make up a decent amount of share of the energy mix,” says Mr Jain. But he remains sceptical about India achieving the target of gas making up 15 per cent of the energy market because there are “bottlenecks”, including the development of the necessary infrastructure, and pricing.

The government is taking steps to boost the process of bringing more gas into India's energy mix.

Mr Modi this month laid the foundation stone in New Delhi for establishing city gas distribution networks in 129 districts. This city gas distribution would facilitate the use of gas in households and for vehicles.

At the launch, he announced an ambition of setting up a natural gas trading exchange. This would enable transparency in terms of the pricing of natural gas.

The government has introduced “several key policy initiatives to grow the sector”, including making efforts to increase domestic exploration and production of gas and halving import duties on LNG to 2.5 per cent, Mr Agarwal points out.

There are also initiatives underway to increase the use of gas for vehicles.

With domestic production still weak, India has outlined plans to scale up it imports of LNG over the next seven years and build an additional 11 LNG terminals alongside the four it already has to deploy these imports.

In BP's latest energy outlook report, which forecasts the global energy market up to the year 2040, it says that “India emerges as the largest growth market for global energy”.

With this rapid increase in the country it predicts that “gas consumption almost triples, with strong growth in industrial sector use, including as a feedstock for production of fertilisers ... but growth of gas in power is less strong, held back by the continued dominance of coal and the rapid growth of renewables”.

But the rise of gas use and the ambitious targets are creating new opportunities for companies.

Adani Gas, the gas distribution arm of Adani Group, headquartered in Ahmedabad in the western Indian state of Gujarat, this month announced its listing on the stock exchanges and has stated that it is aiming to become the largest city gas distribution company in India in the next five years. It recently announced that it had been given the go ahead from the government to expand its city gas footprint in India to locations including areas of the states of Rajasthan and Tamil Nadu. This involves laying city gas infrastructure and supply natural gas. It plans to install a total of 2.3 million domestic piped natural gas connections and about 500 CNG (compressed natural gas) stations in 13 new geographical areas.

“Natural gas is one of the fastest growing sectors globally along with renewable energy,” says Gautam Adani, the chairman of Adani Group. “Its wider adoption can help India raise the quality of life of our people by improving the nation’s exposure to clean and green energy for household and industrial purposes.”

Despite the challenges, India's gas ambitions are firing up.