China is eyeing closer ties with the UAE as the world's top crude importer diversifies its oil and gas assets and navigates US tariffs, a slowdown of Iranian crude exports and a transition to a cleaner economy.

The world’s second-largest economy is in the middle of a makeover to a growth that is less driven by full-throttle industrialisation, characterised by polluting factories that smog up the Beijing skies. China is adopting a cleaner model as it pursues its own ambitions of being a key player in regional and international geopolitics.

To achieve this shift, China is moving away from coal-fired industry and power stations to possibly deriving nearly 85 per cent of all its energy requirements from renewable resources by 2050.

For China, the world’s top consumer of electricity, estimated to have used about 6.31 trillion kilowatt hours in 2017 alone, ensuring consistent and reliable sources of fuel to generate power is critical. For comparison, the US uses about half that amount, the EU about a third. Hence for China, securing enough energy is critical to ensure the smooth functioning of its gargantuan economy and its long-term strategy.

However, a transition to a cleaner economy that will run on energy from the sun and wind is a decades-long process, with China remaining hungry for alternative cleaner fuels to draw down pollution levels.

“In the next two to three decades there will be a gap in this transition. Other cleaner energy needs to fill this gap and it will be something between coal and renewables so it will be cleaner than coal and easier to be used than renewables and that will be gas,” says Kaho Yu, an associate of geopolitics of energy project at Harvard Kennedy School.

China has already made headway in securing gas resources, imported via a pipeline from Russia or Kazakhstan. China also imports cargoes of liquefied natural gas, for which it is the world’s second-largest buyer and on the path to overtake Japan this year. However, CEFC China Energy’s agreement, made in September, to buy a 14.16 per cent stake in Russian oil major Rosneft for $9.1 billion has collapsed following corruption allegations. So beyond Russia, China has upped its search for newer sources and newer partners, including in the Arabian Gulf region.

“If the UAE can secure a gas deal with China or [new] investment with Chinese companies then I think they will bring the energy relationship closer,” adds Mr Yu.

Relations between the Middle East’s fourth-largest producer and the biggest consumer of the region’s oil have edged closer over the past year, with China, an explorer for oil and gas in Iran and Iraq, looking for more stable and secure, lower-cost barrels, in Abu Dhabi.

_______________

Read more:

Adnoc looks to expand partnerships with Chinese oil majors

Adnoc seeks more value creation as it transforms into an integrated company

_______________

Against this backdrop, Chinese President Xi Jinping will be in Abu Dhabi for a three-day visit from today. The historic state visit has been preceded by several high-level visits by Dr Sultan Al Jaber, the chief executive of Abu Dhabi National Oil Company, the UAE’s primary oil producer accounting for about 4.5 per cent of the world’s total output.

Adnoc will look to broaden its engagement with state-owned China National Petroleum Corporation in the downstream value chain during the presidential visit, following Adnoc's recent announcement of the strategy for the sector, an Adnoc spokesman told The National.

The engagement will be in the realm of “polymers, technology and market access” through a strategic partnership, he added. Unlike other Middle Eastern countries, such as Iran and Libya, the UAE is deemed to be “politically stable” with no “major disruptions in its energy sector”, says Christopher Len, a senior research fellow at the National University of Singapore’s Energy Studies Institute.

Foreign oil asset purchases are viewed by China as one of the key pillars to ensure its energy security. Beijing has increasingly looked towards Abu Dhabi to provide cheap risk-free crude, with about 250,000 barrels per day being produced by Adnoc alongside its Chinese partners, with 120,000 bpd destined for China.

Chinese companies, which were awarded about $1bn worth of offshore concessions in March, are also eyeing six blocks on offer as part of Adnoc’s first licensing round this year. At a conference in Beijing in May, Tayba Al Hashemi, acting chief executive of Adnoc unit Al Yasat Petroleum, said Chinese firms had shown considerable interest in the bidding round.

“The awarding of stakes in Abu Dhabi’s offshore and onshore concessions to CNPC is just one example of how the growing energy collaboration is enhancing the broader bilateral relations between the two countries,” a spokesman for Adnoc said.

The UAE’s growing financial sector and place in the Middle East as a major trading hub aligns naturally as China’s connection point in the context of its Belt and Road Initiative, says Mr Len.

Belt and Road, which has become central to China’s foreign policy and economic ventures abroad, was unveiled by Mr Xi in 2013. It seeks to replicate the ancient Silk Road by modern day pathways forged primarily through large-scale infrastructure investment, financed by Beijing.

The initiative, which has resulted in massive Chinese investments along the ancient arteries of commerce in Central and South Asia, as well as stretching to include new territories in Africa, envisions the oil-rich nations of the Gulf as key players along the route.

In one stretch of infrastructure development known as the China Pakistan Economic Corridor connecting the Pakistani eastern port city of Gwadar with the Chinese province of Xinjiang, Beijing saw an easier off-take route for Middle East crude to reach domestic markets.

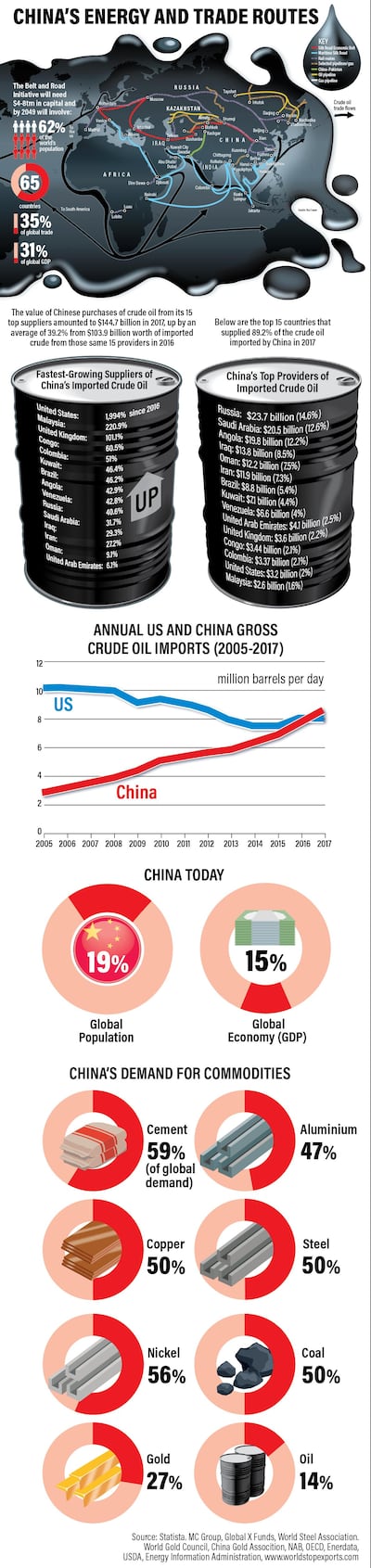

Savings on shipping time and insurance would generate much-needed efficiencies for the Chinese economy, according to Weng Inn Chin, senior oil market analyst at the Singapore office of consultancy Facts Global Energy. China depends on Middle East supply to meet 42 per cent of its crude requirements, with regional imports remaining a “critical component of its fuel mix, even long-term,” he added.

However, other analysts such as Neelam Deo, director of Mumbai think tank Gateway House, differ on China’s achievable ambitions through the CPEC. She notes that development of Gwadar, while championed as a Middle East crude receiving terminal, may be more strategic in nature.

Other analysts such as Amit Bhandari, fellow of energy and environment at the Indian think tank, see Chinese engagement in the UAE as part of a larger trend to secure the adoption for its petroyuan. China advanced the currency in May to allow for oil imports to be priced in the yuan instead of the dollar. The UAE has been an early adopter of the yuan for more than three quarters of all transactions with China and has established a yuan clearing house. China, which over the past year has emerged as one of the top foreign investors in the Abu Dhabi upstream sector, could well include the UAE as part of the petroyuan’s wider circuit.

“China started buying [foreign] energy assets in the late ‘90s and so far they have acquired around one million bpd oil production from these assets,” says Mr Bhandari.

“[To ensure its energy security], China is also trying to convert a larger part of the global oil trade from the dollar to the yuan. The idea is that China is the world’s largest importer of oil in the world right now and they can push for a petroyuan [as] part of [its] larger strategy to try and internationalise its currency,” he adds.

The UAE, which through hubs such as Jebel Ali remains at the heart of global trade, could play a critical role in China’s modern-day Silk Road, particularly at a time of worsening relations with the US after Washington slapped trade tariffs on Beijing this month.

China, which has made its appetite for gas well known in the markets, is considering imposing retaliatory tariffs on US LNG imports, a particularly harsh move at a time of heightened US shale gas supply.

“They need more gas and they would probably need to be cutting down, so it would make sense for them to be looking for additional sources in any case,” says Mr Bhandari.