Iraq is poised to attract significant foreign investment into its energy sector, in tandem with expected higher revenues following the Opec+ decision to raise output that will help strengthen its weak fiscal position.

Baghdad, a founding member of Opec and the group's second largest producer, is forging ahead with a number of public and private sector transactions that the government hopes will shore up its finances after it was forced to devalue its currency last year.

Iraq's investment drive is in stark contrast to its fiscal position last year, when its economy was on the brink of collapse, with the public sector burning through $5 billion month on salaries for government servants.

Oil prices are nearly 50 per cent higher than six months ago and Iraq is allowed to increase crude output as Opec+ looks to bring 2 million barrels per day back in the markets by July.

The Covid-19 pandemic, combined with a decline in oil revenues last year from low global demand and Opec+ output cuts, dealt a severe blow to the country's rentier economy.

The economy contracted 10.9 per cent last year exacerbated by Opec+ curbs and is forecast to grow 1.1 per cent this year supported by a rebound in oil prices and higher Opec+ output quotas, according to the International Monetary Fund. The World Bank estimates the economy will grow slightly higher at 1.9 per cent this year, and expand 6.3 per cent over the next two years.

The rebound in oil prices, the Opec+ output increases for Iraq and government policies are helping shore up the country's foreign exchange reserves, which were strained last year. On Monday, Prime Minister Mustafa Al Kadhimi said Iraq's foreign reserves rose to more than $60bn and credited the increase to his government's efforts to wipe out corruption.

Though its ability to borrow was constrained last year after it exhausted all domestic options, Iraq's credit out look has also improved.

"Progressing and maintaining the fiscal consolidation will be critical for the sustainability of the economy in Iraq, despite the improvement in the oil price," Jihad Azour the head of the IMF's Middle East and Central Asia department, told The National. "The higher oil price is an opportunity to advance on some of the structural reforms that will allow to achieve a higher level of inclusive growth."

Last month, Fitch Ratings affirmed the country's long term foreign currency issuer default rating at B-, while adjusting Iraq's outlook to stable from negative.

Regional investors are cautiously eyeing Iraq as a possible investment destination this year.

The Arab Petroleum Investments Corporation is currently assessing Iraq for possible investments in the traditional energy space as well as in renewables, according to its chief executive Ahmed Ali Attiga.

The multilateral lender, which is owned by the 10 members of the Organisation of Arab Petroleum Exporting Countries, is looking at financing projects in post-conflict oil producers such as Iraq and Libya and plans to disburse nearly $2bn this year.

"Iraq doesn't have the same credit profile [as the UAE or Saudi Arabia]. So they have to think of the mix of resources that they can mobilise including the support of other of multilateral financial institutions, particularly for larger projects in the energy space," Mr Al Attiga said in an interview.

Attracting private investments would be the most "sustainable source" of financing Iraq's government could possibly muster, he added.

On Sunday, Iraq's ministry of finance, General Electric and backers including the UAE's Etihad Credit Insurance finalised the terms on critical power infrastructure rehabilitation projects covering seven plants in the country.

The investment in repairs that will provide stable generation of up to 2.7 gigawatts, was backed by the UAE's export credit company, Etihad Credit Insurance. The ECI will insure GE's debt, provided by lender JP Morgan.

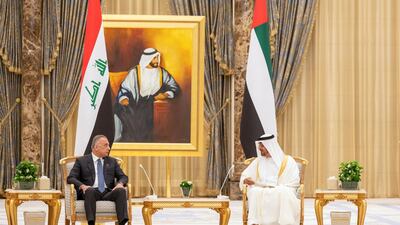

The announcement follows Mr Al Kadhimi's visit to the UAE last week, that saw the Emirates pledge $3bn in investment commitments to Iraq. Mr Al Kadhimi also visited Riyadh, which committed to a $3bn fund for development of critical projects in Iraq.

The regional support is crucial for Iraq, providing backing through the form of export credit financing for foreign investors looking to tap into the country's lucrative energy industries.

Iraq, however, has not only leaned on the strength of its regional bilateral relations. The country is in discussions with French oil major Total for a massive $7bn investment to develop oil and gas fields, cap flaring of gas as well as produce one gigawatt of solar energy, which will be a first for the fossil fuel-reliant state.

The agreement with Total is likely to be concluded "before July", Iraq's oil minister Ihsan Ismael told Asharq News in March.

Baghdad could tap into French export credit agency Bpifrance, providing a guarantee for banks, as well as enter into potential pre-paid oil sales agreement to finance such a massive deal, said an informed financial analyst, who did not wish to be named.

Iraq's credit rating was "significantly higher" than the lowest investment grade awarded by ratings agencies, he added. The country was "punching above its weight" and needed to implement significant institutional changes as detailed in the seminal white paper on economic reform submitted to parliament last year.

"The public sector wage bill continues to increase. They're hiring up to 200,000 more people. The budget was passed with about $20bn in deficit," he added.

Earlier this month, the Iraqi parliament approved a budget of $89.65bn for 2021, with an estimated deficit of $19.79bn. The spending was calculated on the basis of a $45 per barrel oil price with expected exports of 3.26 million bpd. The state will derive 97 per cent of its finance for the budget from the sale of oil.

The IMF expects the price of oil to be about $58.52 a barrel this year and $54.83 a barrel next year. The average price of oil was $41.29 a barrel last year.

Iraq exported nearly 3.4 million bpd in February, including oil sold through Ceyhan, but reduced its volumes considerably to 3.2 million bpd in March, according to Kpler data.

Give the regional support the country has received it is unlikely to violate its quota over the next three months as Opec+ plans to add 300,000 bpd in May and June and 450,000 bpd in July, Homayoun Falakshahi, an oil and gas equity analyst with Kpler, said.