Iraq has taken steps to strengthen its control over the vast West Qurna-2 oilfield, hiring a consortium of oil service companies following the exit of its majority stakeholder, Lukoil, over US sanctions’ compliance requirements.

Basrah Oil Company (BOC), which manages West Qurna-2, has contracted Italian engineering company Bonatti and local firm Hilal Al Basra under a six-month agreement that is renewable once, according to a February 2 letter sent to Lukoil and seen by The National. The Iraqi cabinet had on January 7 instructed BOC to manage operations at the southern field, an Iraqi oil official said.

BOC described the arrangement as a “force majeure mitigation measure” following disruptions declared at the field. The contract requires Lukoil’s approval and the company has not yet responded, the official said. The Russian company was not available for comment.

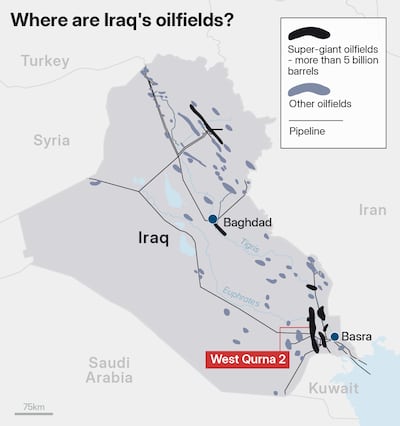

West Qurna-2 is one of the world’s largest oilfields, producing an estimated 460,000 to 480,000 barrels per day. It is estimated to hold about 14 billion barrels in reserves.

Iraq, Opec's second-largest producer, has plans to raise its output capacity to six million bpd by 2029 after years of war, sanctions and underinvestment.

Petroleum operations at West Qurna-2 will be financed through oil sales from Iraq’s Majnoon oilfield, handled by the State Organisation for Marketing of Oil, the official told The National.

The move signals Baghdad’s readiness to run one of its largest producing assets without direct foreign operator control while talks continue over Lukoil’s stake. West Qurna-2, which accounts for nearly 9 per cent of Iraq’s output, is a key contributor to the country's federal budget.

Lukoil agreed last month to a conditional sale of certain overseas assets to US private equity firm Carlyle. The sale of Lukoil’s assets depends on receiving regulatory approval, including clearance from the US Office of Foreign Assets Control and excludes its holdings in Kazakhstan.

In November, Lukoil declared force majeure at West Qurna-2 after being hit by US sanctions alongside Rosneft, as part of US President Donald Trump’s push to increase pressure on Russia over the war in Ukraine. Force majeure refers to unforeseen circumstances that prevent a party from fulfilling contractual obligations. With the exit of Lukoil from Iraq, US oil company Exxon is said to be interested in a stake in West Qurna-2.

Lukoil also holds a 60 per cent interest in Iraq’s Block 10 (Eridu) and a 50 per cent stake in Egypt’s West Esh El Mallaha fields.

Russian energy companies have faced growing operational and financing constraints abroad since the invasion of Ukraine owing to sanctions and compliance risks.