Live updates: Follow the latest news on Israel-Gaza

An escalation in the Israel-Gaza war could hamper Israel’s gas supplies to Egypt and Jordan, exposing the North African nation to the risk of long-term shortages amid tight global supply, S&P Global has said.

In its worst-case scenario of an escalation of the continuing war beyond Gaza's borders and damage to export pipeline infrastructure, gas supplies from Israel will dry up, S&P said in a report.

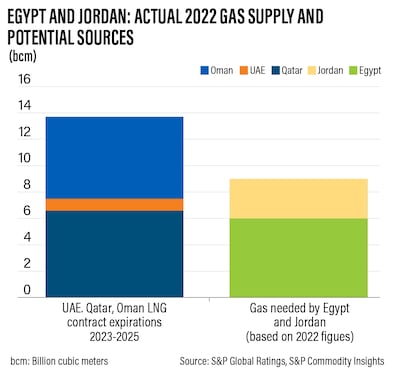

“We believe if that were to happen, Israel's gas exports could stop completely and we don't think many producers in the GCC would be able to fill that gap, since most of their gas production is already under contract,“ S&P analysts said.

“This could leave Egypt facing a long-term shortage at a time when supply is already tight.”

The Israel-Gaza war, which has become a major humanitarian crisis, is further fanning uncertainty in the global economy.

A flare-up of the conflict could disrupt shipping operations through the Strait of Hormuz, limiting energy supplies from the region, which could further slow economic growth momentum already marred by stubborn inflation and high borrowing costs.

Disruption of Israeli gas supplies will add to pressure on the Egyptian and Jordanian economies, both already experiencing a slowdown in the tourism sector, a key source of foreign exchange for each.

An escalation in the war that broke out on October 7 could also have serious consequences for the broader Mena economies, including Israel’s.

However, the S&P base-case scenario expects the war to be largely contained to Israel and Gaza and not last more than three to six months.

Gas production at the Tamar plant had briefly been halted due to its proximity to Gaza.

"We understand production resumed [on] November 9 but the shutdown illustrates the potential repercussions of the war for Israel's gas projects and importers of Israeli gas,” S&P said.

Since 2020, Israel has provided almost all of Jordan's natural gas supply and 5 per cent to 10 per cent of Egypt's, the ratings agency said, citing its Commodity Insights data.

“Yet S&P … believes Egypt's gas supply is more exposed than Jordan's because Jordan has an unused LNG [liquefied natural gas] plant and an offtake agreement with Israel.”

Israel produced about 22 billion cubic metres of natural gas in 2022, about 1 per cent of the global total. It exported a combined 9bcm to Egypt and Jordan, according to S&P data.

Most of Israel's gas production comes from offshore fields in the Mediterranean Sea.

Last year, the Leviathan field produced about 11bcm, Tamar about10bcm and the Karish Main field about 300 million cubic metres.

Production at the offshore Leviathan field has continued but with reduced exports to Egypt and its output is being prioritised for domestic use in Israel.

“The export route to Egypt – the East Mediterranean Gas pipeline – ceased operations when operations at the Tamar field were suspended, with gas now being rerouted to Egypt through Jordan via the Arab Gas Pipeline," S&P said.

Risks to global energy security depend on what happens next in the war, the report cautioned.

“Although energy prices remain volatile amid conflict in the region, we do not foresee a meaningful gap in the supply of oil and gas globally,” S&P analysts said.

“Risks for global energy relate more to the possibility of an impediment to supply through the Strait of Hormuz if there is further escalation … [as] about 30 per cent of the world's seaborne oil and one fifth of global LNG supplies, mostly from Qatar, flow through this channel.”