The Dubai Electricity and Water Authority (Dewa) expects low-carbon hydrogen to play a bigger role in its energy mix in the longer term, according to its chief executive.

“We want to expand [and] we want to make sure it is very competitive,” Saeed Al Tayer told reporters during the Water, Energy, Technology, and Environment Exhibition (Wetex) in Dubai on Wednesday.

Hydrogen and its various low-carbon forms are seen as an alternative to natural gas.

It is a “promising” [fuel] but maybe within the next 8 to 10 years, when technological innovations in the sector will bring manufacturing costs down, Mr Al Tayer said.

Despite hydrogen's increasing appeal in hard-to-abate sectors like steel manufacturing and shipping, critics have questioned its feasibility due to high costs and the lack of a mature market for the commodity.

French investment bank Natixis estimates investment in hydrogen will exceed $300 billion by 2030.

It comes in various forms, including blue, green and grey. Blue and grey hydrogen are produced from natural gas.

Dewa may also explore a project involving batteries next year as the share of renewable energy increases in the Dubai utility’s overall mix, Mr Al Tayer said.

“This project will integrate photovoltaic solar energy panels, capitalising on the rapid technological advancements in battery technology,” he said.

“Our experience with batteries started with a feasibility study, similar to our approach with the hydrogen project, which we believe holds significant potential for the future.

“The pilot phase of the batteries, like that of hydrogen, has shown promise, although it remains costly.”

In August, Dewa filed a patent for a method of improving the performance of electrodes in lithium-ion batteries, sodium – sulfur batteries, and electrolyte distribution batteries.

This year, Emirates National Oil Company joined forces with Dewa to develop and operate a joint integrated pilot project for the use of hydrogen in mobility.

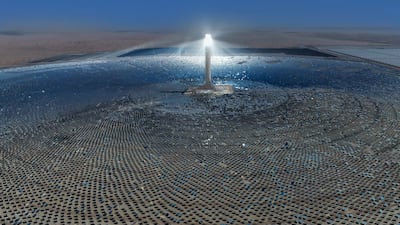

The proposed project would take advantage of Dewa’s existing green hydrogen production facility in the Mohammed bin Rashid Al Maktoum Solar Park and Enoc's knowledge of the fuel market and customer base, the companies said in February.

The UAE, the Arab world’s second-largest economy, aims to achieve hydrogen production of 1.4 million tonnes annually by 2031, increasing to 15 million tonnes a year by 2050.

The country is planning to develop at least two hydrogen production hubs, or oases, by 2031.

Last week, Dewa reported an 8 per cent rise in its third-quarter profit, driven by an increase in demand for the utility’s electricity, water and cooling services.