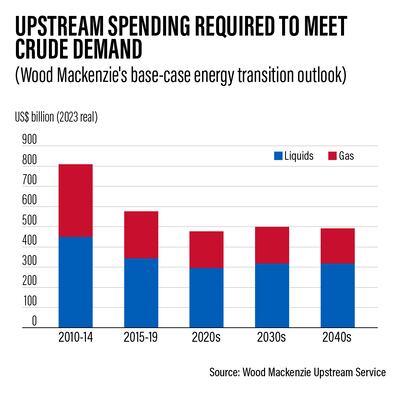

The annual oil and gas investment does not need to rise substantially from current levels of $500 billion to meet peak demand in the 2030s, according to Wood Mackenzie.

Spend levels “not much higher” than the current run-rate can deliver the supply needed to meet demand through to its “peak and beyond”, the energy consultancy said in a research note on Thursday.

This is due to the development of low-cost oil resources, higher capital discipline and a massive improvement in investment efficiency, it said.

“Current upstream spending is a little more than half of the $914 billion 2014 peak … this apparent shortfall has fed a widespread belief that the industry is underinvesting and that a supply crunch is inevitable, be it sooner or later,” Wood Mackenzie said.

International oil majors have reduced spending over the past few years amid increasing pressure from governments and institutional investors.

The International Energy Forum has estimated that annual oil and gas upstream spending needs to increase to $640 billion by 2030, from $499 billion last year, to ensure adequate supplies.

“Our long-held view has been that spending and supply would rise to meet recovering demand and that the upstream industry would not and could not reprise the ignominious years of ‘peak inefficiency’ during the early 2010s,” said Fraser McKay, head of upstream analysis for Wood Mackenzie.

The consultancy expects oil demand to eclipse pre-pandemic highs in 2023 before slowing down next year.

Demand growth will reach a peak of 108 million barrels per day in the early 2030s, Wood Mackenzie said.

Meanwhile, the International Energy Agency expects global oil demand growth to slow significantly by 2028, as high prices and supply concerns hasten the shift to cleaner energy.

In a report last month, the Paris-based agency also said peak oil demand could be in sight before the end of the decade.

Adversity was the “primary catalyst” for a structural change in supply efficiency, with the price shocks of 2015 and 2020 forcing the industry to exercise greater capital discipline, Wood Mackenzie said.

“Conventional greenfield unit development costs have been slashed by 60 per cent in 2023 terms,” said Mr McKay.

“US tight oil wells generate nearly three times more production today for the same unit of capital than in 2014. New technology, capital efficiency and modularisation have been leveraged to powerful effect.”

The industry will focus on resources with the lowest cost and emissions for the rest of the decade, the consultancy said.

Crude supply will become “more expensive” in the future as energy companies start relying on late-life reserves, higher-cost greenfield projects and undiscovered resources, Wood Mackenzie added.

“Counterintuitively, the half-a-trillion [dollar] run rate will need to be maintained beyond peak demand,” said Mr McKay.

Wood Mackenzie said “substantial” investment is required even in the consultancy’s accelerated energy transition outlook, limiting global temperature rise to 1.5 °C by the century's end and achieving net zero emissions by 2050.

The consultancy said that while the impact of underinvestment would be “far reaching”, long-lasting market imbalances are unlikely to persist.

“Energy transition uncertainty adds a new layer of complexity and risk for upstream investors. But the oil market is literally and metaphorically liquid,” said Mr McKay.

“Price signals, reinvestment rates and the actions of Opec+ eventually bring demand and supply back into balance.”