Russia could lose about $85 billion in oil and gas tax income this year due to the discounts offered in Urals blend crude, the country’s key oil reference blend, Rystad Energy has said.

The Urals blend has been trading about $30 to $40 per barrel lower than Brent — the benchmark for two thirds of the world's oil — since April this year, the Oslo-based consultancy said on Tuesday.

With the outbreak of the Russian war in Ukraine in February, the Urals blend started to trade with a large discount to Brent. From mid-February to the beginning of March, the differential increased from $10 per barrel to $40 per barrel — the largest to date.

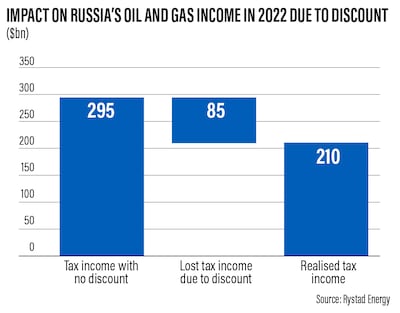

Rystad projects Russia’s income for 2022 to be about $295bn if all oil assets realised the Brent oil price.

By using an average fixed spread of $40 per barrel between the Urals realised price and Brent, Rystad estimated that Russia's tax income will be reduced by $85bn over the whole year. This is a nearly 30 per cent reduction compared to the “no spread” case.

Russia will earn about $210bn in oil and gas tax income this year, Rystad predicted.

The steep discount on Urals shows that some of the sanctions imposed on Russia are having an impact and are “reducing potential oil and gas income to the Russian government”, it added.

“We are starting to see the potential impacts of western sanctions on Russian oil and gas revenue,” said Daria Melnik, senior analyst at Rystad Energy.

“The steep discount on Urals is costing the Russian government, while providing cheaper energy to some Asian economies.”

The six rounds of EU sanctions so far have restricted trade with Russia, isolated its financial system and penalised senior figures in President Vladimir Putin's inner circle.

Brent rose to a notch under $140 per barrel in March, following Russia's invasion in Ukraine. However, all producers are not benefiting equally from the sustained high crude prices as the war — now in its fifth month — continues, Rystad said.

Price differentials between Brent and other crude streams have widened considerably and Brent is currently trading at a premium to almost all other crude streams.

However, Russia’s crude production has proven “surprisingly resilient” to the effects of sanctions, Rystad said. It continued to export crude at pre-conflict levels, following a huge drop in April, while refinery runs and oil output remain strong.

“While the sanctions are likely to hit revenue, oil production has remained higher than expected, demonstrating that Russia’s upstream sector has adapted quickly to sanctions on sales,” Ms Melnik said.

Rystad has revised up Russian crude production for 2022, adding almost 700,000 barrels per day to the previous forecast of 8.7 million bpd.

Crude exports from Russia continued to grow in May and stayed above 5 million bpd in “marked contrast to a widely held belief that exports would fall due to Europe’s deepening cuts to imports”, Rystad said.

Russia has managed to successfully redirect more volume to Asia, primarily China and India.

Refinery runs in Russia also began to recover in May. While Rystad previously expected refinery runs to drop significantly, actual volumes increased by 135,000 bpd to a little more than 5 million bpd.

In June, refinery runs showed an unprecedented growth by 700,000 bpd, driven by higher demand for oil products inside the country.