Lebanon was one of the few markets that emerged unscathed from the 2008 financial crisis, thanks to a prudent regulatory environment, enticing interest rates and a lucky streak. The dynamics have changed over the past ten years, painting a bleak outlook for a country saddled with the third highest debt to GDP ratio in the world.

Ten years ago, Lebanon lured billions of dollars worth of deposits as local banks hiked high interest rates that led to deposit growth reaching 15.6 per cent in December of 2008. In tandem, record oil prices which reached $147 a barrel were a boon to the economy as the Lebanese diaspora sent more money back home, boosting remittances to 12 per cent of GDP that year. Against this backdrop, the central bank, under its long standing governor Riad Salameh, had banned the investment in speculative trading and derivatives thus shielding the country from the US sub-rime mortgage crisis which reverberated globally with the implosion of Lehman Brothers.

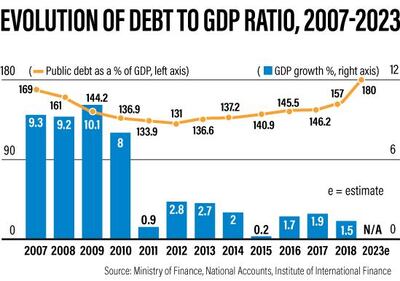

Successive years of strong economic growth which reached 8 per cent in 2008 had also helped lower the country’s indebtedness and provided a sense of security that all was manageable so long as the pace of economic expansion outpaced the growth country's public debt.

“In 2008 Lebanon was not on the verge of a crisis in order to avert one,” said Nassib Ghobil, chief economist at Lebanon’s Byblos bank. “The growth rates were exceptional during this period. Lebanon benefited from the global financial crisis through a high level of capital inflows.”

Fast forward to 2018 and the situation is markedly different.

Today the central bank is engaging in complex financial engineering mechanisms to help keep the country afloat. Public debt is forecast to reach 157 per cent of gross domestic product this year, the highest ratio since the onset of the financial crisis, according to estimates from the International Monetary Fund. Private sector deposit growth reached only 3.8 percent in 2017.

_______________

Read more:

Lebanon’s business conditions in July deteriorate to near two-year low

IMF hopeful of a new government, economic reforms in Lebanon

_______________

The economy, a victim of the country's internal political paralysis and a seven-year war in neighbouring Syria, is projected to grow only 1.5 per cent this year. Lebanon’s private sector business activity recovered slightly in August from the 21-month low reached in July, but was still at the second-lowest level since October 2016, according to the Blom Purchasing Managers’ Index.

Slower economic growth will increase the pace of public debt expansion at a time when the country can ill afford it. Lebanon hosts over one million Syrian refugees and is plagued by the lingering bickering of its politicians that left the country without a president for 29 months until the election of Michel Aoun. Prime Minister designate Saad Hariri has struggled to form a government nearly three months after the country held its first parliamentary elections since 2009.

“Lebanon has had the misfortune to find itself among the few countries which have seen the most significant widening in their risk premia this year (over 200 basis point as measured by the JP Morgan’s Emerging Market Bond Index), which will exacerbate the already challenging fiscal trajectory,” said Maya Senussi, a senior Middle East economist at Oxford Economics. “Debt service is already absorbing about 43 per cent of government revenue (though this is still slightly lower than the outcome of the past decade).”

The country’s debt has grown as a result of heavy state borrowing at high interest rates to finance reconstruction projects in the aftermath of the 1975-1990 civil war. Anaemic revenue growth, partly due to poor tax collection and the public sector crowding out the private sector in terms of borrowing, is coupled with heavy expenditure on wages and transfers to the loss-making electricity utility.

All of these factors have worsened Lebanon’s public finances.

Lebanon’s debt-to-GDP ratio could balloon to 180 per cent by 2023 if the government fails to undertake reforms that narrow its fiscal deficit, which may reach 10 per cent of GDP, the IMF has warned. The country managed to lower its public debt from 180 per cent of GDP in 2006 to 131 per cent in 2012 with the help of higher economic growth.

Higher interest rates pose a threat to Lebanon’s public finances because they increase the cost of servicing the debt, which in turn pushes the country to borrow further to cover the shortfall.

The silver lining is that more than half of Lebanese debt is denominated in Lebanese pounds and all the local debt is held by domestic banks. Nearly 43 per cent of the public debt is denominated in foreign currency and held mostly by local banks and the central bank, leaving some $9bn or 11 per cent of the total debt in the hands of foreign investors, according to Mr Ghobril.

“We expect deposit inflows to remain resilient despite the latest political headwinds and delays in the formation of a new government – partly because of the central bank's stabilising policies and higher deposit rates offered by banks,” said Elisa Parisi-Capone, Moody’s lead sovereign analyst for Lebanon.

“Although the banking system's track record through periods of past political shocks shows a significant degree of resilience, this resilience could be tested in a prolonged period of uncertainty.”