November 4 marks the end of the grace period after which the US government re-imposes sanctions on Iran.

US President Donald Trump announced his intention this year to withdraw from the Iran nuclear agreement, or Joint Comprehensive Plan of Action (JCPOA), signed in 2015, and invoked a law in August to re-impose sanctions lifted under the deal.

Starting next month, any business with unlawful ties to one of the region’s largest economies could be heavily penalised or even blacklisted by US authorities.

What is the JCPOA and why did President Trump withdraw from it?

The JCPOA is a deal brokered by former US President Barack Obama between Iran and the US, UK, Russia, China, France and Germany, also referred to as P5+1. Iran agreed to rein in its nuclear programme by cutting its stores of enriched uranium and other components needed to build nuclear weapons. In return, the P5+1 countries agreed to lift some of the punitive trade sanctions that the US, United Nations and European Union had imposed against Tehran for years, which had cost the Iranian economy billions of dollars a year in lost oil revenues. Some – not all – of the sanctions were lifted at the start of 2016.

Mr Trump has described the JCPOA as “one-sided” and the “worst” deal the US has ever signed up to. He claims the terms are insufficient to prevent Iran from acquiring nuclear weapons. In May, he announced the US was withdrawing from the deal and would impose “the highest level of economic sanctions” on Iran, despite resistance from other members of the deal.

What sanctions are being brought against Iran?

The first set of sanctions were imposed in August, following a 90-day wind-down period after the US withdrawal from the JCPOA in May. These sanctions primarily target persons and companies working in or with Iran’s mining, automotive and public finance sectors. Although that round was expected to have an impact on the Iranian economy, the more significant wind-down period is due to expire on November 4, when a second set of sanctions takes effect. These include additional blocks on Iran’s oil, shipping and energy sectors, as well as certain transactions by foreign financial institutions. There are both primary and secondary sanctions (see below).

How will US companies be affected?

They are mainly affected by primary sanctions, which apply to all transactions and activities with a US connection, including US individuals, US dollar transactions, US products (including products that contain US-controlled content), and US-owned or controlled foreign subsidiaries, including those based in the Middle East. Enforcement is overseen by the US Treasury’s Office of Foreign Assets Control, and non-compliance can result in civil and/or criminal penalties. In the GCC and wider Middle East, any regional subsidiary of a US company is at risk if it does business with Iran or otherwise transacts the Iranian rial. Such companies will be curtailing Iranian operations so as not to get caught.

How will Middle East companies be affected?

They could be impacted by secondary sanctions, which have extraterritorial reach. This means that US authorities can target non-US companies and persons, including those in the Middle East, for engaging in sanctioned activities. Such activities include business that helps the Iranian government to acquire US dollar banknotes and precious metals; deals with Iran’s automotive, shipping and energy sectors including the purchase of petroleum, petroleum products, or petrochemical products from Iran, and transactions by foreign banks involving the Iranian rial.

“The impact of sanctions can be felt [in the Middle East] ... with a lot of US companies having foreign subsidiaries and branches in this region,” said Kerry Contini, Washington-based international trade partner at law firm Baker McKenzie. Even if there is no obvious basis for US authority, secondary sanctions can still apply, forcing companies to choose between not doing business with Iran or risking penalties. “Closely examining contracts with US suppliers, customers and intermediaries will be key to protecting firms,” Ms Contini said.

Who can still do business with Iran?

Iranian companies with operations outside of Iran, for example in the Middle East, would generally not be impacted. There are also several permitted types of Iran-related business. For example, sanctions are not supposed to target the provision of consumer goods to Iranian citizens. "Companies that are confident they are not engaging in activities targeted under US sanctions may be willing to risk it and stay," said Ms Contini's colleague Matt Shanahan, financial services regulatory partner at Baker McKenzie Habib Al Mulla in Dubai.

Banks and money exchange companies are adopting a conservative position and generally refusing to do direct or indirect business with Iran because of the additional compliance checks. This means the flow of funds is being interrupted and legitimate business is struggling to be transacted, Mr Shanahan said. In short, companies are not getting paid. At the same time, compliance complexity and costs are increasing, further reducing companies’ appetite to deal with Iran. “We’re seeing some companies, as a matter of internal policy, adopting the position that they’re not going to touch anything related to Iran,” Mr Shanahan said.

For European companies there is another issue. In July, the EU updated legislation that essentially makes it unlawful for EU companies to comply with US sanctions, “because [Brussels] is at loggerheads with the US and trying to keep the Iran nuclear deal alive”, says another lawyer, who asked not to be named. These companies may still opt to pull out of Iran as they weigh the risk of EU enforcement action with the fact that it is so difficult for them to get paid. France's oil major Total is one such company that withdrew from Iran. The company pulled out of Iran in August, abandoning its commitment to a $4.8 billion Iranian gasfield project. Air France and British Airways no longer fly to Tehran.

_______________

Read more:

Sanctions-hit Iranian banks have little scope of international business

Iran to face recession as US sanctions bite

Iran under increased pressure to bring in financial reforms

_______________

How are businesses in the UAE coping with sanctions?

Banks are highly cautious and the resulting payment issues make it challenging to do business with Iran. Banks and remittance houses may also be worried about scuppering business relationships. If they fall foul of the rules, their US correspondent banks could end agreements with them and they would have no way of transferring dollars. The stakes are too high to risk an entire business.

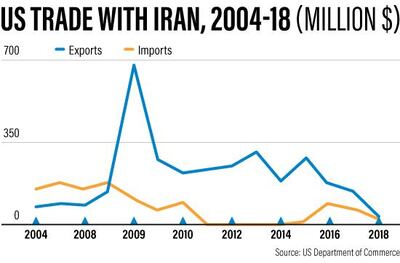

The JCPOA did little to significantly boost economic activity in Iran, and only a handful of GCC companies expanded operations to service Iran once sanctions were lifted. Banks in particular maintained a conservative approach. For that reason, the re-imposition of sanctions may not have a notable impact in the GCC.