Federal Reserve officials were strongly leaning towards cutting US interest rates in September, while “several” had seen the case for a July rate cut, according to last month's meeting minutes released on Wednesday.

According to the minutes, a “vast majority” of Federal Open Market Committee members believed that “it would likely be appropriate to ease policy at the next meeting” if data in the coming months came in as expected, pointing to a probable rate cut in September.

While all FOMC members agreed to hold interest rates at the Fed's current target range of 5.25 to 5.50 per cent, “several observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision”, minutes from the July 30-31 meeting read.

The Fed has held its benchmark rate steady since July 2023. The central banks of the UAE and Saudi Arabia, which follow the Fed's decisions, have also held their interest rates steady.

Markets have already priced in a September rate cut, with most traders expecting a quarter-rate cut, according to the CME Group's FedWatch tool.

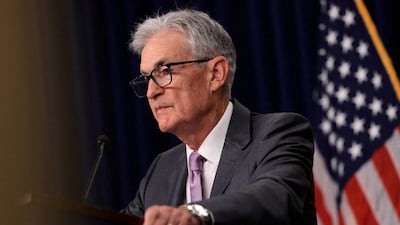

Fed chairman Jerome Powell indicated a September rate cut during his post-meeting press conference in July.

Mr Powell said a rate cut would be “on the table” in September if inflation moves down in line with expectations, if growth remains “reasonably strong” and if the labour market moves as expected.

Labour market concerns

The minutes also reaffirmed the Fed's move towards focusing on the labour market. Officials noted that upside risks to inflation have diminished, while downside risks to employment had increased.

Unlike other central banks, the Fed has a dual mandate of price stability and maximum employment.

“Some participants noted the risk that a further gradual easing in labour market conditions could transition to a more serious deterioration,” the minutes read.

Minneapolis Fed president Neel Kashkari recently went further in his assessment of the economy, telling The Wall Street Journal that the labour market “is showing some concerning signs”.

The Fed has been dealing with a delicate balance during its most recent phase of its inflation battle. Cutting rates too soon could reignite inflation, whereas holding them for too long could lead to a deterioration of the jobs market, and a recession.

A Labour Department report released days after the meeting showed monthly job growth slowed to 114,000 in July and that the unemployment rate rose to 4.3 per cent, initially sparking concerns of a US recession.

However, economists noted the increase in the unemployment rate was caused by more people entering the labour force, as opposed to lay-offs.

Earlier on Wednesday, a Labour Department report showed its initial total payroll estimate from April 2023 to March 2024 was 818,000 lower than previously thought. Monthly job gains averaged 174,000 compared to what was previously reported at 242,000.

“Even with the revisions, the economy has created a boatload of jobs and trend job growth is strong, just not sufficient to keep up with growth in the working-age population,” wrote Ryan Sweet, chief US economist at Oxford Economics.

After the meeting and subsequent data on jobs and inflation, most Fed officials have said they are getting closer to cutting interest rates.

Fed govenor Michelle Bowman still seemed uncertain on cutting rates, saying on Tuesday that she remains “cautious in my approach to considering adjustments to the current stance of policy”.

The Fed is scheduled to hold its next two-day policy meeting from September 17-18.

All eyes on Jackson Hole

Attention now turns towards the Jackson Hole symposium, an annual gathering of central bankers at the mountain resort in Wyoming.

The Federal Reserve chairman's keynote address is often considered the most important event during the gathering, and this year will be no different as financial markets will be tuned in to Mr Powell's remarks at 10am ET on Friday.

In recent years, the Fed chairman has used the Jackson Hole address to first preview the central bank's aggressive rate-raising cycle and later discussing the uncertainty of the US economic outlook.

Kevin Burgett, an economist at the LHMeyer advisory firm in Washington, does not expect Mr Powell to go beyond the remarks he made a the July conference.

“First, Powell’s not naturally inclined to use this venue to shape policy,” Mr Burgett wrote to clients.

“Second, the way he left things at his July post-meeting press conference suggested he was unlikely to use Jackson Hole to comment on hot-button policy issues such as the pace of cuts, and circumstances since then aren’t pushing him to do so.”