Women returning to the workforce following a career break have the potential to contribute nearly $385 billion to aggregate gross domestic product of nine countries in the Middle East and North Africa region, according to PwC Middle East.

This indicates a “significant” economic potential, if organisations can adopt “supportive” measures to ensure a smooth transition for women back into the workforce, the consultancy said in its latest report.

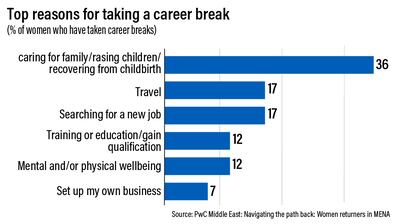

The survey of 1,200 women across the UAE, Saudi Arabia, Qatar, Egypt, Bahrain, Jordan, Kuwait, Lebanon, and Oman found that nearly half of women in the Mena region have taken career breaks, typically due to family and caregiving responsibilities.

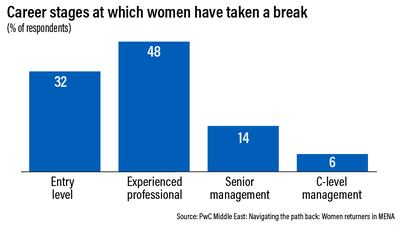

More than two thirds of those women have job experience on higher than entry-level posts, and more than 82 per cent of those who re-entered the workforce said they aim to advance their careers to senior positions.

In recent years, countries in the broader Mena region have experienced a rise in women's participation in the workforce. The World Bank said last November that the GCC countries in particular have witnessed "a remarkable increase" in female labour force participation as the region seeks to rapidly empower its non-oil sectors.

According to the International Monetary Fund, the GCC has increased its average female labour force participation by more than 10 per cent over the past two decades.

However, women’s role in economic activities still falls short when compared to countries with a similar GDP per capita.

PwC said nearly half of those surveyed said they had had job applications rejected due to gaps in their resumes.

Returning to the workforce poses challenges such as employer stigma, inflexible working arrangements and the risk of slower career progression or reduced earnings due to being “mommy tracked”, the report said.

Survey findings indicated that longer periods of unemployment made re-entry more difficult.

“Women returning to work face obstacles to career advancement as employers do not view career breaks favourably, which results in negative impact on earnings and career progression,” said Norma Taki, a Middle East inclusion and diversity leader, transaction services partner and consumer markets leader at PwC.

“However, career breaks can offer profound personal growth opportunities,” Ms Taki said.

PwC said that providing alternative work models such as flexi or remote working can help women balance their work and home responsibilities in a way that suits them.

Allowing women to work additional hours by granting them flexibility could also lead to GDP gains of up to $4.3 billion, the report said.

“To encourage women to return to the workforce, it's important to have more equitable parental leave policies, along with well-designed returnship programmes,” PwC said.

“Businesses must also address the risk of unconscious bias by implementing inclusive workplace policies and training for teams, leaders, and talent acquisition,” the report added.