The increasing participation of women in Saudi Arabia's workforce is expected to boost the country’s economy by $39 billion, or 3.5 per cent, by 2032, if the current rate of growth continues, according to S&P Global Ratings.

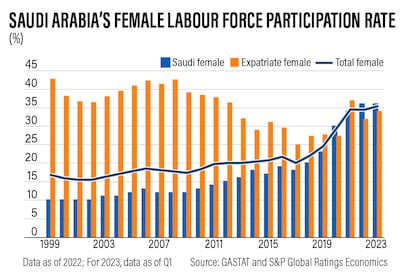

Labour market reforms have led female labour force participation for Saudi nationals to nearly double to almost 36 per cent in 2022, from 19 per cent in 2016, the rating agency said in a new report.

This boosted the overall participation rate to a record high of 61.7 per cent in March 2023, compared with a record low of 54.2 per cent in June 2017.

While the biggest jump in Saudi Arabia's female labour force participation has clearly already happened, even smaller, steady increases would continue to benefit the world’s 17th largest economy.

“We calculate that increases in overall participation rate of just 1 percentage point per year (ppt) over the next 10 years would boost the country’s annual real GDP [gross domestic product] growth by an average of 0.3 ppt, to 2.4 per cent per annum (versus 2.1 per cent), assuming that labour force productivity growth for the next 10 years will look the same as the last 20 years,” S&P research analysts said in the report.

Saudi Arabia’s ambitious Vision 2030 diversification programme, announced in 2016, aims to boost women's participation in the workforce, among other objectives.

The initiative targets increasing employment opportunities for women, especially in the private sector, to three million by 2030 and increasing female labour force participation to 30 per cent by the same time.

Saudi Arabia's economy grew by 1.2 per cent in the second quarter of this year, a slightly faster pace than the initial estimates, driven by a sharp expansion in the non-oil sector of the Arab world's biggest economy.

The country has been working to diversify its economy away from oil with a number of government programmes to spur business and create jobs. The Vision 2030 agenda plans to lower the Saudi unemployment rate to 7 per cent.

The unemployment rate for Saudi women fell sharply to 16.1 per cent in the first quarter of 2023, from 20.2 per cent a year ago, while it reached 4.6 per cent for men, down from 5.1 per cent a year earlier, the General Authority for Statistics (Gastat) said in June.

Female representation in the labour force increased to 36 per cent over the past three years, from 20 per cent, Jadwa Investment said in an April report. The increase was spurred by expanding childcare and transport services, which added to new job opportunities in developing sectors such as tourism, leading to more women joining the labour market, it said at the time.

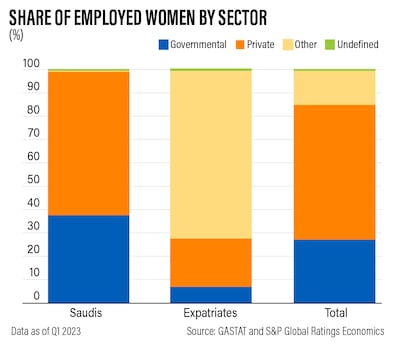

Sixty per cent of Saudi women are employed in the public sector, while nearly 67 per cent of working expatriate women are employed in other sectors such as non-profit organisations, domestic work, and regional and international organisations, the S&P report found.

Higher education drives female advancement, according to S&P. Only 16 per cent of employed expatriate women in Saudi Arabia hold a bachelor’s degree and 41 per cent of them have only some level of secondary education, highlighting the education and the types of degrees women generally attain in the country, it said.

“A plurality of Saudi women (35 per cent) work as managers, followed by clerical jobs (21 per cent). Among expatriate women workers, nearly 80 per cent are engaged in sales/service roles (travel attendants, personal service workers, etc) or elementary occupations (cleaning, domestic and office help) involving physical labour,” the report said.

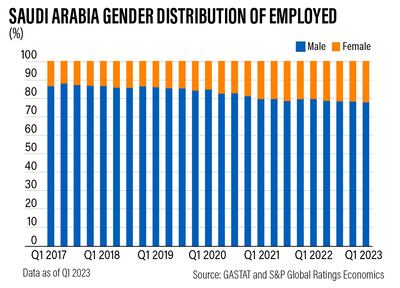

While globally, men are still more likely than women to work outside the home, the disparity has narrowed significantly in the past 50 years, S&P said, adding that Saudi Arabia is taking steps to close this gap.

Overall female labour force participation rate (nationals plus expatriates) in the kingdom jumped to 35 per cent in 2022 from 17 per cent in 1999, with most of the increase coming since 2016, according to S&P estimates.

The increase in Saudi Arabia’s share of working women can be attributed to “improved female education and cultural liberalisation”.

Nearly 32 per cent of women aged 25 and up in the country held at least a bachelor’s degree in 2020, versus 26 per cent in 2017, higher than in some other developed or regional peers, the report said.

The female share of graduates from science, technology, engineering and mathematics programmes stood at 36.8 per cent in 2018 – on par with or above countries like the US (38 per cent), the UK (34 per cent), France (32 per cent) and Germany (28 per cent).

Other measures introduced by Saudi Arabia to reduce the impediments to women joining the labour force include allowing them to drive, increasing remote and hybrid work arrangements, dropping the need for a male guardian to consent to a woman starting a business, and increasing the number of female jobs in the military, S&P said.