The global economy is "teetering on the brink of recession" as the war in Ukraine, Covid-19 lockdowns in China and a hawkish US Federal Reserve weigh on activity worldwide, the Institute of International Finance said in a report.

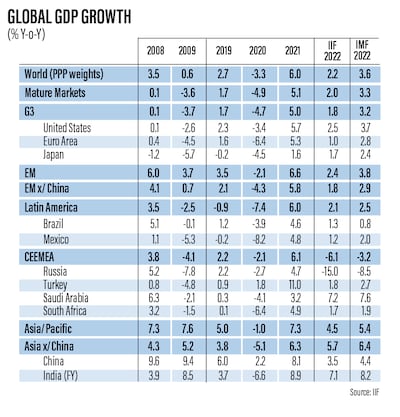

In its latest forecast, the IIF estimates global gross domestic product to grow 2.2 per cent this year, with activities slowing to 0.5 per cent in the fourth quarter. The Euro area as well as emerging markets, excluding China, are anticipated to go into a recession by the end of the year.

"Since the statistical carryover from 2021 is 2.3 per cent, this is a de facto flatlining of global GDP," the report said.

The IIF's estimates are below the latest prediction from the International Monetary Fund, which has also lowered its growth forecast this year, due to the Ukraine war and inflation stoked by soaring commodity prices.

The IMF projects global growth at 3.6 per cent this year and next, down 0.8 and 0.2 percentage points from its January forecast, respectively.

With the possibility of a recession, market regulators must approach policy normalisation more cautiously, the IIF said.

"In the past, rising uncertainty and mounting recession risk have had important effects on investor psychology, making markets less tolerant of monetary policy tightening that is seen as no longer warranted," the institute said.

It cited the Fed's last rate hiking cycle in December 2018, which it was forced to end abruptly after the S&P 500 index fell sharply. Markets judged that hike to be "unwarranted", given the escalating trade war between the US and China at the time, the report said.

"The risk of a similar market tantrum is rising again now as markets fret about a global recession. The Fed has locked in a steady pace of balance sheet run-off to start in June, amid a very sharp tightening in US financial conditions that looks on the verge of becoming disorderly," it said.

The Fed’s hawkish stance towards rate increases comes amid the volatility in energy and commodity markets caused by Russia’s invasion of Ukraine.

In March, the Fed approved a quarter percentage point rise, following two years of keeping the rates near zero, as the world's largest economy attempted to curb soaring inflation, which hit the highest level since 1981.

Earlier this month, the Fed further raised its short-term interest rate by 50 basis points, its most aggressive decision since 2000, with a further seven to nine interest rate rises expected in 2022 and 2023.

Meanwhile, the European Central Bank is also expected to announce its first rate hike since 2011 in July.

"The first interest rate hike is now being priced in for the monetary policy meeting of July 21, and that seems realistic to me," Klaas Knot, president of Dutch De Nederlandsche Bank, told Dutch TV earlier this week.

While the rate should be raised by 25bps, if inflation is seen "broadening further or accumulating", a bigger increase must "not be excluded", Mr Knot said.

"In that case a logical next step would amount [to] half a percentage point."

Several other governments around the world have also adopted rate hikes in recent months to tackle inflation. Many emerging and mature market economies have entered the Fed’s latest rate hike cycle with high levels of dollar-denominated debt, the IIF said in an earlier report.

Global debt surged to a record $305 trillion in the first three months of this year as the US and China — the world’s two largest economies — continued to borrow amid slowing economic growth. Debt currently stands at more than 348 per cent of the global GDP.

"The Fed and the ECB ... need to proceed with great caution in their desire to normalise policy. Better to pause than to backtrack, given that high inflation raises the cost to central banks’ credibility of a policy reversal," IIF's latest report said.