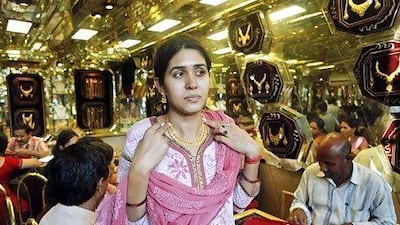

Arendra Thakur, a commander in the Indian navy, splashed out 250,000 rupees (Dh16,697) on gold jewellery for his wife and daughter at a jewellers in Mumbai over the weekend.

Prices were higher than last year but he could not forgo the annual tradition of buying gold for the Diwali festival, he says.

"Every year I purchase some items for Diwali. Everybody buys gifts for the celebration."

The gold price in dollars is up on the festive season last year and weakness in the Indian rupee against the dollar pushes that rate even higher. As a result, gold prices in India in rupees are much higher at about 32,000 rupees per 10 grams compared with about 27,000 rupees during the festival last year.

Even though jewellery shops across India have been busy as usual with customers for Diwali, shop owners say the expense is dampening demand.

"Prices are high, so customers are a little hesitant to buy gold right now," says Dheeraj Jain, the co-owner of Surana Gold, a jewellery shop in Mumbai. Most purchases were normally made during the festival and even just after, so it is too early to predict whether it will turn out to be better or worse than last year, he adds. "Let's hope for the best," says Mr Jain.

Rajendra Gurjar, the owner of the Gurjar Gold and Diamond jewellers, says sales are flat so far on last year.

"Gold prices are increasing," he says. "But that means that customers can gain on the gold they buy."

Diwali is keenly watched by international gold traders because of the effect it has on physical gold sales.

India is the world's biggest consumer of gold jewellery and Diwali, which is followed by the wedding season, is a peak period for sales.

Compared with past years, demand ahead of the festival has been slack, Gerhard Schubert, the head of precious metals at Emirates NBD, wrote in a research note.

"The strength of physical buying out of India has still been underwhelming, but there have been pockets of very good demand from the subcontinent," he says.

"Diwali is upon us and it is too early to state the level of additional sales visible for the festival compared with normal market expectations.

"Nevertheless, last week was the week for the gold bugs as the market demonstrated some strength in depth and vigour."

Gold investment and jewellery demand in India fell to 181.3 tonnes in the second quarter of this year, down from 294.5 tonnes during the same period last year, according to data from the World Gold Council, citing the fluctuations in the rupee and inflationary pressure in India.

Investment demand in India, at 56.5 tonnes, was less than half the level it was in the second quarter of last year, while demand for gold jewellery in India declined 30 per cent to 124.8 tonnes during the quarter, the data showed.

Gold prices globally have picked up on the back of actions by the United States Federal Reserve to steady the world's largest economy.

Two rounds of quantitative easing, followed by the Fed's "Operation Twist" last year and a third open-ended round of bond-buying have all contributed to inflationary fears - prompting a rush towards havens such as gold.

Since 2007, the price of bullion has increased by more than 150 per cent to about US$1,730 per ounce.

The Fed has been joined by pledges of additional bond-buying from the European Central Bank, the Bank of England and the Bank of Japan, which have contributed to boosting the price of the yellow metal in recent months.

However, economists are sceptical of how much longer gold's allure can last for investors.

"You're only entitled to one 30-fold bull market once in a generation," says Richard Hoey, the chief economist at BNY Mellon.

"The fundamental today is low, short-term interest rates relative to inflation," he says. "I believe real short-term interest rates adjusted for inflation in important financial centres is a crucial determinant in the interest in gold. We're probably at the lowest ever seen in world history."

Whether the historic highs will be sustained throughout another five years of Diwali festivals is unlikely but he says the question is when gold will retreat?

"There's a day of reckoning of higher interest rates to come in the coming years," he adds.

"But I'm not convinced it's going to start soon."