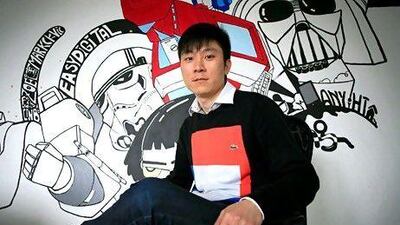

When he launched Wimi Media in June last year, he and his partners "felt the funding squeeze", says Fu Jun.

Their Shanghai company, which deals with online video advertising, had a modest 2 million yuan (Dh1.16m) in start-up cash, despite the industry being, according to Mr Fu, capital-intensive.

"The five of us were previously in the [media] industry and we had some clients. Otherwise we wouldn't have been able to get by," he says. "We were determined to stay in the industry and see it through because we believe the market is big, but we really needed the capital to back it up."

They knew from the start they would be turned down by China's state-run banks.

"It's just pointless to try to get funding from domestic banks," says Mr Fu, who in his 40s and is the deputy general manager at Wimi Media, an online advertising company. Wimi acts as an intermediary between firms that advertise their products or services online, and Web video companies such as Youku, the Chinese equivalent of YouTube.

"The state companies, they don't attach enough importance to the small and medium-sized companies and they're letting the situation deteriorate and letting these companies starve," he says.

Many other budding entrepreneurs in the small and medium-sized business sector in China feel the same.

Chris Ruffle, the chief executive of Open Door Capital Group, which is based in Shanghai and invests in smaller companies in China, has seen the problems at first hand.

"It's been a chronic problem, especially recently for smaller companies for the bank finance. They have been thrown back into the hands of loan sharks," says Mr Ruffle.

When it comes to problems caused by "loan sharks", nowhere in China has suffered more than Wenzhou, a south-eastern city famous as a centre for freewheeling capitalism.

Last year, a string of business owners fled and factories were closed down when companies could not cope with the exorbitant interest rates, sometimes 90 per cent a year, charged by underground lenders. Some company owners even committed suicide.

The city's entrepreneurs had been forced into the clutches of illegal lenders because state-run banks were reluctant to offer funds after credit tightening instructions from the central bank.

It was an acute illustration of a widespread issue, namely the preference state-run banks have for lending to state-owned enterprises instead of private-sector companies, which are perceived as being riskier.

With the state setting deposit and interest rates, the banks make vast profits, much to the frustration of small companies starved of cash, and householders receiving miserly interest rates on their savings.

Entering his final year in office, the Chinese premier, Wen Jiabao, has been talking tough, indicating the practical monopoly operated by China's big four state-run banks -Industrial and Commercial Bank of China (ICBC), Bank of China, Agricultural Bank of China and China Construction Bank - must be broken.

ICBC, the world's largest bank by market capitalisation, generated a profit of US$33.1 billion (Dh121.58bn) last year.

"Our banks make money too easily. Why? Because a small number of big banks have monopoly status. To allow private capital to flow into finance, basically, we need to break the monopoly," Mr Wen told business people during a visit to Fujian province on April 3.

Foreshadowing the wider banking reforms of which Mr Wen spoke, Wenzhou, appropriately enough, has been selected for an experiment in private banking.

Private investors are being allowed to set up loan companies and banks, and acquire stakes in existing local lenders. State-owned banks will be encouraged to lend to small companies.

A statement released by the State Council, China's cabinet, said Wenzhou could "serve as an example for financial reform and economic development nationwide".

Many of those at the sharp end, such as Mr Fu, agree this could be the start of something big, as private capital has been "waiting so long" to enter the banking industry.

"Once it's there, I think it will be much more sensitive to the real needs of small and medium-sized companies than those big state banks because the people behind it started as businessmen," he says. "No matter what industry needs help, private capital will sniff out where the money is."

Sharing his optimism about the reforms is Chen Ruihai, 37, who founded Changzhou Haiying Electronics, a company in Changzhou in eastern China's Jiangsu province that imports and sells items such as ATMs.

Founded in 2000, the company employs 10 people, half of them in sales.

"I'm sure those privately funded banks will have a better idea about issuing loans because they are close to the market and they know which companies are going to grow fast and which are not," he says. "They will have much more autonomy because what the boss says, counts. In big commercial banks, the actual manager may not have the authority to decide whether to lend the money or not, because they have so many rules."

Like many others, Mr Chen knows from bitter experience the difficulties small and medium-sized businesses can have securing loans.

In 2008, he approached some of the large state-run banks for a loan to buy new equipment, but found "they just pushed me away". He eventually secured a loan from a local bank.

He says large banks are "so rigid" in terms of rules and stipulations when deciding on loans.

"Even if they agreed to lend me the money, it wouldn't help because the application process is so long I would probably go bankrupt if I waited," he says.

Analysts as well as entrepreneurs see advantages in the banking trial in Wenzhou, believing it will have benefits that go beyond helping companies that struggle to secure credit.

"If the banking industry can be more competitive, I think that will result in a more efficient allocation of capital, [which] is important for the future growth of China," says Stephen Ching, an associate professor in the University of Hong Kong's school of economics and finance.

For the likes of Mr Fu, the latest developments are a welcome change to government policy that previously "did not attach enough importance" to small and medium-sized companies.

"The trial zone in Wenzhou is a very good policy. It's almost like the unleashing of a very strong force," he says.

twitter: Follow and share our breaking business news. Follow us