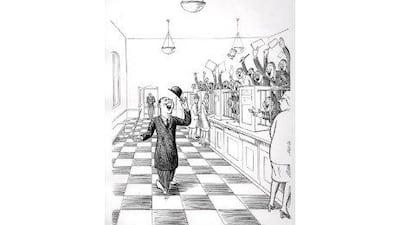

When I try to imagine an absolute and fundamental expression of joy, I invariably remember the features of "The Man who Paid off his Overdraft" depicted in the Bateman cartoon of the same name and first published in Punch magazine in the 1930s.

The lucky former debtor beams from ear to ear as he tips his hat in self-satisified amusement at the attending throngs of jubilant bankers. He is the very image of happiness.

You will not see many like him in Europe these days, and certainly not in Spain where household indebtedness continues to soar to perilous levels.

His infectious smile has been noted, however, in the United States. And in increasing numbers, too.

In a report that passed by almost unnoticed last week, overshadowed by the escalating travails of the Spanish banking sector, the US Federal Reserve remarked that Americans managed to reduce their household debt burden in the first quarter.

Admittedly, they only crept 0.4 per cent closer to the black but importantly it was the 16th quarter in a row that Americans reduced their overall personal debts. That's a total of four straight years, or almost the entirety of the global financial crisis that began in 2008.

Within the 0.4 per cent headline figure is hidden an impressive 2.9 per cent reduction in mortgage debt. Seeing as this financial crisis was born in the housing market with an enormous asset bubble, such a distinction should not be ignored.

At the same time, US household wealth has increased a fair bit too, meaning Americans are accumulating more assets outright, which is what happens when you pay off your mortgage.

The total value of assets - such as houses - is also creeping up.

Paying off debt is often pooh-poohed by bankers - the ones who make money out of indebtedness, of course - and economists, who theorise that saving stifles growth. And so it does, but in such terrible economic circumstances as we find ourselves today, reducing gearing, leveraging down, paying the piper or however you would like to put it, is a must.

The world needs to return to a position where it can safely accumulate a sensible level of debt to stimulate growth. And America's households, if not its federal government, are well on their way towards that end. Worringly, however, Europe is still a long way off.

The European Commission has guidelines on private sector debt - that includes household and private company debt. As a rule, the EC says that private sector debt should not exceed 160 per cent of GDP.

But in a recent study the European executive body sounded the alarm as 15 of the EU's 27 member countries exceeded that safety cut-off, led by Ireland with a whopping private sector debt of 341 per cent of GDP.

In Spain, public sector debt is still only 61 per cent of GDP but private sector debt is worth a huge 227 per cent.

Spain is one of the worst offenders but France, Germany and the United Kingdom are not far behind.

It's all relative of course. One good measure of the significance of household debt is to compare it as a ratio to disposable income. Again Spain appears to be the worst offender.

German households have a lot of debt, but only borrow on average about 50 to 60 per cent of their disposable income. British households are a little more carefree, with debts equal to between 70 and 80 per cent.

But travel on down to Spain and the data tells the whole story. In 2002 the Spanish borrowed just 45 per cent of their disposable income. By 2007 that level had shot up to more than 70 per cent and by 2009 it was approaching 100 per cent. And that is why the Spanish banking sector needs €100 billion (Dh459.81bn) to get back on its feet. It lent a huge amount of money to people who couldn't pay it back.

When we analyse the global financial crisis we tend to focus on seemingly big things such as GDP, national debt, unemployment rates and banking sector bailouts.

The statement from the credit card company and the mortgage lender seem insignificant in comparison. But cumulatively they are just as important as the numbers that steal the headlines.

It is only through the proper management of these personal debts that we can ever hope to re-emerge from this crisis.

And by the looks of things the US has about a four-year lead on Europe, which can only mean there is still a long way to go.

twitter: Follow and share our breaking business news. Follow us

iPad users can follow our twitterfeed via Flipboard - just search for Ind_Insights on the app.