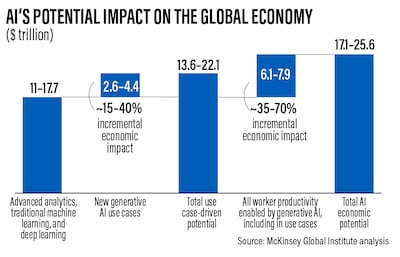

Generative AI could add as much as $4.4 trillion annually to the global economy and will transform productivity across sectors with continued investment in the technology, according to a new study.

The higher end of $2.6 trillion to $4.4 trillion annual economic contribution range of generative AI eclipses the entire gross domestic product of the UK that reached $3.1 trillion in 2021, consultancy McKinsey said in its report The Economic Potential of Generative AI: The Next Productivity Frontier.

Generative AI is estimated to add 15 per cent to 40 per cent to the $11 trillion to $17.7 trillion of economic value that McKinsey estimate non-generative artificial intelligence and analytics could unlock.

The latest estimate is an upgrade from 2017 when the consultancy estimated AI to deliver $9.5 trillion to $15.4 trillion in economic value.

“About 75 per cent of the value that generative AI use cases could deliver falls across four areas: customer operations, marketing and sales, software engineering, and research and development,” McKinsey analysts said in the report.

Generative artificial intelligence is a type of AI system that can generate text, images, or other media. These models use neural networks to identify patterns and structures within existing data to generate new and original content.

Researchers examined 63 use cases across 16 business functions in which the technology can address specific business challenges in ways that produce one or more measurable outcomes.

“Examples include generative AI’s ability to support interactions with customers, generate creative content for marketing and sales and draft computer code based on natural-language prompts, among many other tasks,” the report said.

The sudden emergence of AI chatbot ChatGPT and other tools have jump-started investment in the AI sector. More than $2 billion worth of investments were made in generative AI sector in 110 deals in 2022 alone, according to Goldman Sachs.

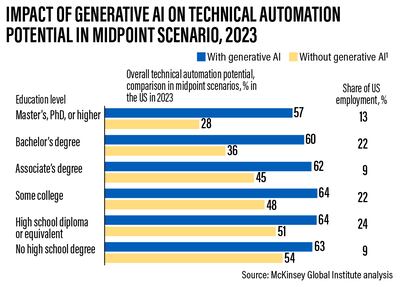

The US investment bank estimates that 25 per cent of current work tasks could be automated by AI in the US and Europe alone, with traditionally high-skill, non-routine jobs such as legal and financial operations highly susceptible to automation.

While the rapid evolution of AI is expected to automate tasks and boost productivity, experts warn of numerous risks, putting pressure on governments and regulators to accelerate the pace of legislation to match the pace of the industry’s development.

This month, US President Joe Biden meet industry leaders to discuss the “risks and enormous promises” of artificial intelligence.

Ahead of the meeting, major AI companies, including Microsoft and Alphabet’s Google, committed to participating in the independent public evaluation of their systems.

There is a wide range of estimates available on generative AI’s economic potential as the industry continues to evolve.

In April, Goldman Sachs said the sector could drive a 7 per cent – or almost $7 trillion – increase in global GDP and lift productivity growth by 1.5 percentage points over a 10-year period.

“Despite significant uncertainty around the potential for generative AI, its ability to generate content that is indistinguishable from human-created output and to break down communication barriers between humans and machines reflects a major advancement with potentially large macroeconomic effects,” Goldman Sachs economists Joseph Briggs and Devesh Kodnani wrote in a report.

Though generative AI will have a significant impact across all industry sectors, banking, high tech and life sciences are among the industries that could see the biggest impact on percentage of their revenues from generative AI, McKinsey said.

“Across the banking industry, for example, the technology could deliver value equal to an additional $200 billion to $340 billion annually if the use cases were fully implemented,” the consultancy said.

“In retail and consumer packaged goods, the potential impact is also significant at $400 billion to $660 billion a year.”

The rapid development of generative AI also has the potential to “change the anatomy of work” and can automate work activities that absorb 60 to 70 per cent of employees’ time today.

It can also substantially increase labour productivity across the global economy, but that will require continued investments, the report said.

Generative AI could increase productivity growth by 0.1 to 0.6 per cent annually through 2040, depending on the rate of technology adoption and redeployment of worker time into other activities.

“The era of generative AI is just beginning. Excitement over this technology is palpable, and early pilots are compelling,” the McKinsey report said.

“But a full realisation of the technology’s benefits will take time, and leaders in business and society still have considerable challenges to address.”