Renewed social unrest in Tunisia could hamper the government's attempts to put its economy on a stronger footing following the damage caused by Covid-19 and could delay its negotiations with the International Monetary Fund for a much-needed debt restructuring.

"Without a government in place, there is no momentum to push through much-needed and unpopular fiscal consolidation to address Tunisia’s fragile public finances," said James Swanston, an economist covering the Middle East and North Africa for London-based Capital Economics.

"Admittedly, if after 30 days President [Kais] Saied has formed a new government, it could pave the way to unblock the political impasse ... but this seems quite unlikely."

Mr Saied sacked the country's prime minister Hichem Mechichi on Sunday and froze parliamentary activity for a month, bringing to a head a political crisis that has been dragging on for two years – a move that could derail its economic reforms.

An uprising in the country more than a decade ago toppled its longtime dictator Zine El Abidine Ben Ali and plunged the country into economic chaos.

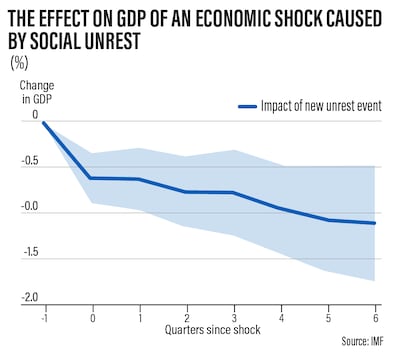

The Reported Social Unrest Index, a measure developed by IMF staff, found that disturbances within a country can shave between 0.2 per cent to 1 per cent off a country's gross domestic product, depending on their severity.

Economic growth can also remain lower than pre-disturbance levels for up to 18 months after a major protest, according to the fund.

"These effects on GDP seem to be driven by sharp contractions in manufacturing and services and consumption. Our findings also suggest that social unrest affects activity by lowering confidence and increasing uncertainty," a blog published by the multilateral lender earlier this month found.

Tunisia's economy had already been in a weakened state before Covid-19, with its fiscal deficit averaging 5 per cent of GDP in the decade ending in 2019, according to Capital Economics.

The budget gap increased to 10.6 per cent of GDP last year as 2.6 billion dinars ($946m) was pumped in to support its economy and is forecast to hit 9.3 per cent this year, according to the fund.

Tunisia's government requested help from the Washington lender in May for a support programme that would alleviate the country's plight. The programme was reported to involve reforms including cuts to the public sector wage bill but faced stiff opposition from the country's main labour union.

Government debt has increased sharply to about 90 per cent of GDP, driven by the country's high public sector wage bill, generous subsidies and support for weak state-owned enterprises, Mr Swanston said.

About two thirds of this is owed to external borrowers and denominated in foreign currency, leaving the country vulnerable to a fall in the value of the dinar.

The dinar was trading at its lowest for more than a year at 2.8074 against the US dollar at 2.50pm on Monday.

"Much-needed fiscal consolidation measures are needed but against the backdrop of the political crisis and a weak economic recovery, it will prove very difficult to push through," said Mr Swanston.

"Ultimately, we think the government will be forced to restructure its debts."