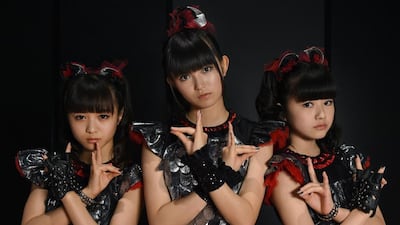

The Japanese pop-metal group Babymetal have toured with Lady Gaga and attracted monster crowds in America and Europe with their sugar-coated brand of hard rock, but the schoolgirl trio have even bigger plans – to conquer the world.

Dressed in frilly red skirts and with their hair in ponytails, the teenagers say that their whirlwind success has fuelled their appetite to dominate the heavy-metal scene.

“Our goal is not to be number one,” says Su-metal, the 16-year-old lead singer of the band, before a high-octane performance in front of 20,000 headbanging fans at Tokyo’s Summer Sonic music festival. “Our aim is to be the only one.”

Babymetal shot to fame in 2011 when their single Doki-Doki Morning went viral on YouTube. Their fusion of J-pop and thrash metal forged a new genre they call "kawaii [cute] metal" and earned them slots at festivals alongside rock giants such as Metallica, Iron Maiden and Anthrax.

A phone call from Lady Gaga followed and they opened a handful of shows for the Born this Way singer this month.

“When we heard we would be supporting her, we couldn’t believe it,” says Su-Metal. “She told us to keep working hard to be the best we can be. She’s amazing, the power she has.”

Their overseas shows went down a storm with metal fans unfamiliar with Japanese pop culture and its conveyor belt of bubblegum teen idols.

“When people saw us for the first time they were just open-mouthed,” says Su-metal. “Then they really got into it and started wearing Babymetal T-shirts. We’ve taken Japan’s ‘idol’ music genre of pretty girls singing and dancing and added kawaii metal, which is totally new.”

Babymetal had no idea about heavy metal before forming four years ago.

“We had no clue what heavy metal was,” says Yuimetal, 15. “We were like: ‘What’s that?’ At first we had a scary image of metal and it was hard to approach other artists. I’m not sure we understand metal perfectly yet, but we’ve met lots of bands and they’ve all been really sweet to us.”

Babymetal rocked a crowd of 50,000 at Britain’s Sonisphere festival in July, which was headlined by Iron Maiden, The Prodigy and Metallica.

“Last year, we met Metallica for the first time at Summer Sonic,” says Yuimetal. “They were so kind to us it felt like they were uncles of ours. Then we heard them play, they were pure heavy metal – they were so cool.”

Babymetal's theatrical live show is punctuated by cutesy dance moves, pouting and fluttering eyelashes, and is powered by a ghoulish zombie band that includes a guitarist in a long white dress and with lank hair, who bears a striking resemblance to the ghost in the Ring series of Japanese horror movies.

Security at the festival began lifting fans crushed against the barrier in front of the stage to safety as soon as they tore into the second song of their set, the hit single Gimme Chocolate!!

The pint-size trio, who stand on boxes for much of their show, merrily chirped “Please give me chocolate quickly, chocolate quickly!” as middle-aged heavy metal fans in Motorhead T-shirts moshed sweatily alongside teenage girls dressed like their idols.

“We do still get nervous, but once we get up there the metal gods protect us so it’s fine,” says the 15-year-old Moametal, referring to the name the girls use to describe their backing group.

“The European tour was a dream come true. We played in front of 50,000 [at Sonisphere] but we couldn’t hear much until we took our ear-monitors out. Then we could hear all this screaming – they were going crazy, which was a relief.”

Despite their astonishing rise to stardom, the bubbly threesome say they are just regular schoolgirls.

“Right now we’re Babymetal,” says Yuimetal. “But usually we’re just normal junior-high-school and high-school students. We do our best to combine our two lives.”

At an age when most mums worry about their daughters doing their homework, Su-metal says that parental support has played a big part in the band’s success.

“My mum wasn’t the sort of person who would ordinarily listen to heavy metal,” she says with a grin. “But she thinks Babymetal’s songs are cool. She’s a big fan.”

Moametal sums up the trio’s exuberance, just before going on stage.

“It’s such a thrill seeing fans wearing our T-shirts. It’s brilliant being in Babymetal.”