If you look at the grainy black-and-white images from the Emirates Fine Arts Society’s very first exhibition, in 1981, you will see paintings hanging from temporary walls and room dividers and people jostling for space in a crowded room.

This was the UAE’s art scene at a time when, although it had no international presence, it was thriving and buzzing regionally and many of today’s well-established artists were just beginning their careers.

It is scenes like this from which Sheikha Hoor Al Qasimi took inspiration when curating artworks by Emirati artists for next month’s Venice Biennale, where the UAE has had a permanent pavilion in an ancient renovated building in the shipyard district since 2013.

Under the title 1980 – Today: Exhibitions in the United Arab Emirates, Sheikha Hoor, who is also president of the Sharjah Art Foundation, conceived the show as a retrospective of contemporary art exhibitions in the Emirates over the past 40 years, and selected from EFAS archives more than 100 pieces of art from 1968 to 2002.

The space

The artworks are all placed within a 250-square-metre space on a custom-designed grid of mobile, vertical walls and on an elevated floor – so that some of the work can be viewed through “windows”. The design will also incorporate sunken alcoves and pedestals for the many objects of art. “It is a visual presentation rather than a chronological one,” Sheikha Hoor says. “The timelines all cross over anyway and even though the artists were working together at the time, they had their own identity. I also noticed connections between a lot of the works that were unintentional, but it was something I wanted to explore as the curator.”

The artists

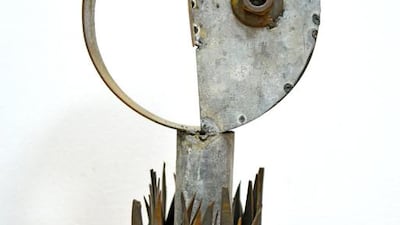

Fifteen Emirati talents will showcase their paintings, sculptures, ceramics, reliefs, photographs and even a collection of old notebooks from the veteran contemporary artist Hassan Sharif. Artists who have become renowned for a particular style will be presented through their much earlier works. Abdul Qader Al Rais, for example, best known for his landscapes and abstract paintings, will exhibit a series of figurative paintings, while Najat Meky, who works primarily on paper and canvas, will show sculptures.

The journey

“Nobody knows the scene in the UAE and I’ve grown up alongside it. It was a different landscape then. Everyone knew what the others were doing and it was very inclusive,” says Sheikha Hoor, adding that she even found pictures of her own paintings in the archives.

“However, not everybody has had the same opportunities so I wanted to present a lot of artists that maybe the younger generations wouldn’t know so well but who were working alongside the others at the same time. It is important people are aware of that.”

Despite being thorough in her research, Sheikha Hoor admits that the show is still far from being a comprehensive historical diary and has been, in many ways, a personal journey. “I was born in 1980, so for me it is almost like it is a lifetime of research and a personal reflection as well,” she says.

The support

The UAE pavilion is commissioned by the Salama bint Hamdan Al Nahyan Foundation. Its founder, Sheikha Salama bint Hamdan Al Nahyan, says she is “delighted” to be working with Sheikha Hoor. “Thanks to her vision and leadership we are able to share essential works from this key period in the UAE’s art scene and also to build links for future generations. “I applaud her contributions to the development and advancement of the larger discourse on art from the region.”

• The 56th Venice Biennale runs from May 9 until November 22 (the preview runs from May 5-8). The official opening of the National Pavilion of the UAE is on May 7 at 4.30pm. For more information, visit www.nationalpavilionuae.org

aseaman@thenational.ae