John Taylor is an only child, so if he has ever experienced anything remotely like a family road trip, it was probably while on tour with Duran Duran.

The British rockers are set for a "family reunion" as they head out for a new run of international dates in the months ahead, taking in North and South America and Europe, to support their new album, Paper Gods.

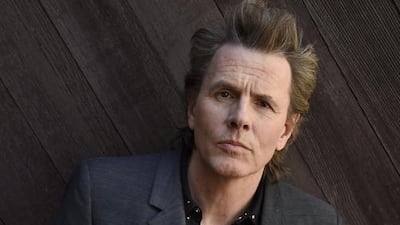

The 55-year-old bassist took time out from the preparations to share a few secrets about himself and the musical family he calls Duran.

Touring now is not like it was in the band’s heyday

“When people say what’s it like now compared with how it was, they’re probably thinking of the crazy 1980s – particularly the early 1980s, where the band sort of cruised at a very high altitude. Well, I wouldn’t want to work like that again.

“We were quite young – we’d only been in the business for, like, two years, when it started taking off. We weren’t really – well, I wasn’t really – ready for it. It’s like being given your first car – and it’s a Ferrari. So now we’re in a Buick. It’s a very sedate Buick, but it gets around into all the sightseeing trips. It’s good.”

The band reinvents itself with every album

“It’s like a restyling exercise, always. And I think that’s the blessing and the curse of being in Duran, which is a band whose blueprint was really based on being modern. We weren’t like the [Rolling] Stones, who are rooted in R&B. We just had this thing, and it’s essentially kind of a good thing because it allows us to change and morph.”

The other band members have no idea what lead singer Simon Le Bon was going on about in some early songs

“In the 1980s, Simon had a very specific way of writing lyrics – which was amazing – and half the time I had no idea what he was singing about. None of us really did – but it didn’t matter, because the pictures he was making were extraordinary.”

Taylor was disappointed that last year’s Paper Gods album did not get a Grammy nod

"That was just something that was driving me through the second year of the making of Paper Gods. I was like: 'This is why I'm doing it.' None of the rest of the band could care less, but it was driving me."

Regret that the internet has made music so easy to “burn through”

“All art, whether it’s music or painting or cinema, it’s got a shelf life. It doesn’t matter how good you like it, you’re going to burn through it. And there’s something about delayed gratification. Certainly to me, some of my favourite music, it took me a long time to get hold of it and when I got it, it was precious. I knew every note, every beat. Now, music’s almost too accessible. It’s too easy to get a hold of. Now I almost want music to be harder to get. I need to work for it – and that way I will appreciate it more.”