Bollywood stars are coming under sharp criticism for using their fame to endorse products that some fans and activists find distasteful, from skin-fairness creams to alcohol. We took a look at a number of artists making such endorsements – a staggering list of top actors including Shah Rukh Khan – as well as the growing number of celebrities who are taking a stand being socially responsible.

Aishwarya Rai Bachchan

Aishwarya Rai Bachchan, wife of actor Abhishek Bachchan and a member of the celebrated Bachchan clan, was caught up in a controversy this month over a jewellery advertisement. It showed the 41-year-old actress resplendent in ornate jewellery, sitting on a chaise longue in front of a painting of a dark-skinned, emaciated child holding a giant parasol, in what seemed to be a misguided throwback to 18th-century paintings depicting European noblewomen with native servants. The advertisement was condemned by social activists in India: for being allegedly racist and for encouraging child labour. Their open letter to the actress said: “You appear to be representing aristocracy from a bygone era – bejewelled, poised and relaxing while an obviously underage slave-child, very dark and emaciated – struggles to hold an oversize umbrella over your head.” The advertisement was withdrawn, then re-released with the offending painting Photoshopped out.

Kalyan Jewellers, the company behind the advert, apologised saying: “The creative was intended to present the royalty, timeless beauty and elegance. However, if we have inadvertently hurt the sentiments of any individual or organisation, we deeply regret the same.” Rai’s publicist said that the actress had been unaware of the creative team’s visualisation.

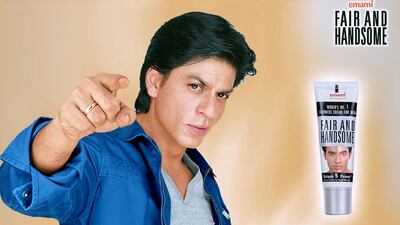

Shah Rukh Khan

SRK is the undisputed king of endorsement. A study last year by the US consultancy firm American Appraisal on the value of the top 15 celebrity brands in India had Khan at No 1 with a $100 million (Dh367m) valuation. Although he has endorsed all manner of products – from luxury watches and cars to talcum powder and hair oil – Khan’s most controversial endorsements include paan masala, an areca nut-based mouth freshener and mild intoxicant that has been allegedly linked to oral cancer. Last month, the Indian media reported that Khan had just finished shooting an advertisement promoting a well-known paan masala brand. Medical research suggests that paan masala could be more harmful than cigarettes. SRK was reportedly paid 200 million rupees (Dh11.52m) for the advert.

Khan is also the face of the skin-fairness cream Fair and Handsome for Men, a product of the Indian company Emami. He came under flak for apparently promoting the idea that fair skin is superior, in a country where people with dark skin regularly face discrimination. An online petition last year urged the 49-year-old actor to shun such products.

After the flak that Khan received, it came as a surprise when Hrithik Roshan signed up last month as the face of the new Fair and Handsome face wash, eight years after Khan started promoting the brand – the commercial is expected to be released soon.

Like many stars who have been questioned about their endorsement choices, Roshan put the usual spin on it, saying the face wash “brightens” the skin rather than lightens it. Roshan reputedly commands 20-30 million rupees per brand.

Deepika Padukone

A-lister Deepika Padukone, 29, is the latest actress to jump on the fairness bandwagon and is the face of Neutrogena fairness cream. She is in the company of Aishwarya (Fair & Lovely fairness cream and L’Oreal White Perfect fairness cream), Katrina Kaif (the 31-year-old star endorses Olay Natural White fairness cream) and Priyanka Chopra, the 32-year-old crossover actress who promotes Garnier Fairness cream.

“When famous global brands such as Garnier and L’Oreal entered the fairness-cream market, these creams became more acceptable to big stars as products to endorse than some of the less-than-glamorous Indian brands,” says former advertising executive Kamal Bhasin.

Padukone, who recently starred in a video by filmmaker Homi Adajania to promote women’s empowerment and was lauded for breaking the taboo on discussing depression after she revealed that she had struggled with the condition, has upset fans who see her as a youth icon. Padukone allegedly makes 60-70 million rupees per brand.

Ajay Devgn

Advertising alcohol on television in India is banned, but some companies have got around it through surrogate advertising. Ajay Devgn, the husband of A-list actress Kajol, has endorsed Bagpiper whiskey in a similar fashion, in a commercial that implicitly suggests the alcohol brand without actually mentioning it.

A few years ago, he was asked by a reporter from Mumbai's Daily News Analysis newspaper why he chose to endorse the brand. Devgn's reply was defensive: "Many other stars have also been associated with Bagpiper so I don't see a problem endorsing soda and the other products of the label."

When asked how he felt about famous Indian cricketer Sachin Tendulkar and superstar Amitabh Bachchan refusing to promote liquor brands, he said: “I don’t know.”

Amitabh Bachchan

Amitabh Bachchan, Aishwarya Rai Bachchan’s father-in-law, told an audience in Ahmedabad last year that he stopped endorsing Pepsi after a visit to a school where he was confronted by a little girl who asked him why he promoted the sugary drink.

Bachchan said he now performs “due diligence” before signing on the dotted line. “I look into it ... I meet the client and ask them about it,” said the 71-year-old actor. “I don’t endorse tobacco or alcohol because I don’t consume them, so why should I endorse them?”

artslife@thenational.ae