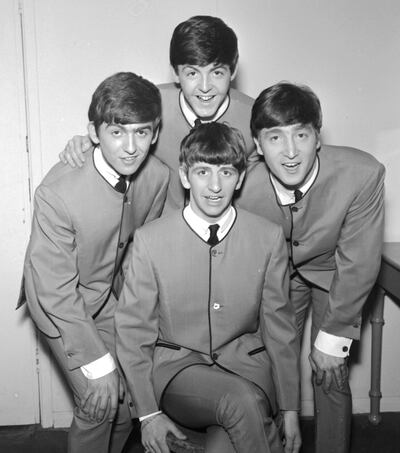

Paul McCartney will recall his life through song, literally.

The singer, 78, has announced a two-volume memoir, The Lyrics: 1956 to the Present, reflecting on his six-decade career, from the heady days of The Beatles and Wings to his solo success.

Out on November 2, McCartney will explore these career stages through the prism of a select 154 songs.

Intriguingly, the songs – spanning 900 pages – will be ordered alphabetically, thus allowing the reader to dip in and out of the book as opposed to following the standard chronological memoir format.

In addition to the lyrics, McCartney will delve into the inspirations behind the songs when they were written, as well as adding his thoughts on them now.

The book will also be bolstered with fresh photographs, letters and drafts taken from the artist’s personal archive.

A look back on the classics

Explaining the unorthodox nature of the book, McCartney said – through publisher Penguin Books – it was largely down to him not keeping copious notes over the years.

“More often than I can count, I’ve been asked if I would write an autobiography, but the time has never been right. The one thing I’ve always managed to do, whether at home or on the road, is to write new songs,” he said.

“I know that some people, when they get to a certain age, like to go to a diary to recall day-to-day events from the past, but I have no such notebooks. What I do have are my songs, hundreds of them, which I’ve learnt serve much the same purpose. And these songs span my entire life.”

Edited by Paul Muldoon, the book is based on conversations the Irish Pulitzer Prize-winning poet shared with McCartney.

“Sir Paul and I met regularly over a period of five years for two or three-hour sessions in which we talked in a very intensive way about the background to a half-dozen songs,” Muldoon said.

“In a strange way, our process mimicked the afternoon sessions he had with John Lennon when they wrote for the Beatles. We were determined never to leave the room without something interesting.”

Considering the amount of literature already out on the Fab Four, McCartney hopes his work will provide fresh insights for even the most ardent Beatlemaniac.

“I hope that what I’ve written will show people something about my songs and my life which they haven’t seen before,” he said.

“I’ve tried to say something about how the music happens and what it means to me and I hope what it may mean to others, too.”

Books by The Fab Four

The Lyrics: 1956 to the Present joins a select number of books either authored by or completed with co-operation from members of The Beatles.

The first official book about the group was 1968's The Beatles: The Authorised Biography by Hunter Davis.

This was followed by George Harrison's 1980 memoir I Me Mine and the McCartney-authorised 1997 biography Paul McCartney: Many Years from Now, written by Barry Miles.

While John Lennon never wrote a memoir or authorised a personal biography, the singer did write three books collecting his short stories, poetry and prose. They include 1964's In His Own Write and 1986's posthumously released Skywriting by Word of Mouth.

McCartney's non-Beatles related material includes the 2001 poetry collection Blackbird Singing: Poems And Lyrics 1965-1999 and 2005 children's book High in the Clouds, co-written with Philip Ardagh.