The release this week of South Korean singer Psy's follow-up to his 2012 internet phenomenon Gangnam Style appears to confirm what music lovers everywhere secretly hoped: yep, he's a global one-hit wonder.

The bad news is that, although Gentleman, streamed live to the world from its debut at a Seoul concert on Saturday, looks and sounds depressingly similar to its predecessor - complete with dumb electro-beat and purposefully inane and easily mimicked "dance" - all the signs are that it will prove a similarly gigantic internet phenomenon.

Brace yourself for countless YouTube parodies and an endless parade of celebrities and world leaders keen to get in on the act.

The only question now is whether Gentleman will surpass Gangnam's record as the first (and so far only) YouTube video to score more than a billion views - and the signs are good. Gangnam began as a slow-burner, but within 24 hours Gentleman had 20 million views, easily shattering Justin Bieber's one-day record of eight million for Boyfriend.

By yesterday it was up to almost 140 million views and galloping up iTunes charts around the world.

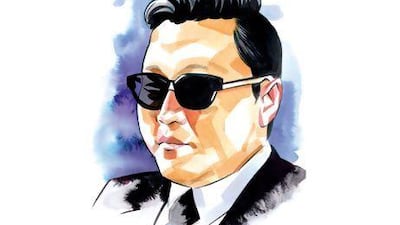

Of course, to describe the 37-year-old Psy as a one-hit wonder, or as an overnight success, is to express a strictly Western perspective on an artist who released his first single in South Korea back in 2001. For the past decade, the pudgy Psy has had a successful, if somewhat left-field, career in K-Pop, a music scene more typically dominated by young and pretty girls and boys.

Although Psy admits he was something of a misunderstood misfit in his school days, his story is not so much rags-to-riches as riches-to-yet-more-riches.

He was born in 1977 as Park Jae-sang, the son of wealthy South Korean businessman Park Won-ho, chairman of a middle-sized semiconductors manufacturing company. His mother, Kim Young-hee, is a successful businesswoman in her own right, owning several restaurants in Seoul.

Psy - or Sai, as his friends originally nicknamed him - grew up on the south bank of the Han river in the affluent Gangnam-gu area of Seoul and by all accounts Psy slipped easily into the role of spoiled child. At school, certainly, he was the pupil most likely to ... well, disrupt the other pupils.

"I remember Psy making a lot of sexual jokes during class," a former middle-school teacher recalled in October for the benefit of Seoul Broadcasting System's Good Morning show.

"He had such a big influence that he would drive the entire class to his jokes. I disliked him at the time, but looking back, he added a great energy to the class."

"Energy" was one way to describe it. The same show dug out an early interview clip of Psy admitting: "I bothered a lot of my classmates because I didn't like going to class. Some of the kids even sent me threatening letters that said if I bothered them once more they wouldn't stay put."

Psy, being groomed to take over the family business from his father, had his heart set on performing, rather than working, for a living.

"When I was a kid, one of my dreams was to be a stand-up comedian, or a talk-show host, or something like that," he told CNN during an interview in November.

But then, at the age of 15, he was watching TV and saw the British band Queen performing their 1975 hit Bohemian Rhapsody - and, "I was like, literally gone".

Gone or not, in the summer of 1996 Psy's parents sent him to the US to take an English programme in preparation for an undergraduate course in business administration at Boston University. He completed the summer language class but lasted just one semester before dropping out from university - without telling mum and dad.

"In Korea, it's a tradition to inherit your father's business," Psy told The Daily Beast in October last year. "Unfortunately, I'm the only son in the entire family, so they were forcing too much."

For Psy getting into hip-hop was inspired by the apparent ease of producing rap music and he blew his university money on recording equipment. "I thought, wow, just saying the words fast I can be a singer," he said.

While his parents contentedly believed he was still studying business, he switched to studying music. In the summer of 1997 he took a five-week performance programme at Boston's Berklee College of Music and, that autumn, enrolled in an undergraduate course.

It came as news to his parents - and not from Psy. "In May 1998, Berklee sent a letter to my father about Parents Day," Psy told The Daily Beast. Dad was not best pleased.

Once again, however, Psy failed to stay the course, and left after a year, in the autumn of 1998 - but something had clearly stuck. Back in South Korea, Psy threw himself into his music and, in February 2001, released his debut rap album, Psy From the Psycho World.

It would be another 11 years before Psy had any impact on the wider world, but at home he was big from the off. The "rookie singer", declares his biography on South Korea's KBS World Radio site, "stirred up the Korean pop music scene with very blunt lyrics, peculiar dance moves and his unconventional appearance".

He was promptly nicknamed The Bizarre Singer - and equally promptly he was banned. Five months after the album's release, the "in-your-face lyrics [that] especially appealed to the younger generation of Korean music fans" had the opposite effect on the country's leaders, and sales of Psy From the Psycho World were forbidden to juveniles.

An arrest and fine for smoking marijuana followed shortly.

It's doubtful it did his Korean career any harm. In January 2002, the same month as his trial, he released his second album. Predictably, For Adults was also banned for those under 18.

Psy was on a roll. His third album, Champion, was released in September 2002 and, says KBS, he "continued to hold his spot as an artist that fans loved for his unconventional ways and refusal to adhere to society's and the industry's mold".

But then ... cue the sound of stylus being pulled off a record.

For reasons anyone who has been following the news of the past few weeks will understand, military service in South Korea is compulsory and, in 2003, Psy was called up to do his bit to keep the communist hordes at bay.

Once again, he failed to stay the course. The available details are vague, but it seems Psy somehow shortchanged the Republic of Korea. The result was that, in August 2007, two months after his wife Yoo Hye-yeon, a cellist, had given birth to their twin daughters, he was called up again.

It probably hadn't helped win him any friends in the military when, in 2004, while he was supposed to have been toeing the line on the demilitarised zone, he made the mistake of making an ill-judged excursion into anti-American politics.

Appearing at a rally in Seoul, sparked by the deaths in 2002 of two Korean schoolgirls who had been run over by an American military vehicle, he performed a song called Dear America. The lyrics, though the subject of some translational debate, appeared to urge the murder, "slowly and painfully", not only of Americans responsible for torturing Iraqi captives, but also their families.

Not that it stopped President Obama shaking hands with Psy at a "Christmas in Washington" concert in December. Even the leader of the free world, it seems, wants a slice of the Psy popularity pie.

Oddly, given that Psy is the biggest international pop star South Korea has ever produced, his KBS World Radio biography runs out in 2010, the year of his comeback after his second stint of military service.

"True to form," sniffs the last entry, "he's been embracing the fact that he's nowhere close to idol status. Sticking to his usual style without the overusage of the ever-so-popular auto-tune voice synthesizer, Psy's showing another successful run with his music."

And how.

Who are Psy's fans? Well, according to The Economist, which in October grumpily tried to analyse the Psy phenomenon, mainly girls aged 13 to 17 and young men between 18 and 24. But who can forget the sight of everyone from UN secretary-general Ban Ki-moon to dissident Chinese artist Ai Weiwei doing the horse dance?

Especially and mysteriously irksome to The Economist was the peculiar effect Psy's success had had on his dad's company, DI Corporation. Making "products with distinctly unsexy names, like Monitoring Burn-in Tester and Wafer Test Board", it reported in October, it had lost money in each of the past four quarters. And yet, after Gangnam Style, its share price galloped from $1.80 to $5.12 in just three weeks - and continues to float at a higher level than before.

The Economist judged the new stockholders to be retail investors, buying blind as part of South Korea's peculiar "theme stock" trend - though "quite how they expect the horse-dancing YouTube phenomenon of 2012 to help DI sell more of its Wafer Test Boards is a mystery".

Many will dismiss the new Psy single as another valueless piece of transnational cultural garbage, of no more significance than the countless quirky-kittens videos on YouTube (and possibly of less musical merit than the multimillion-viewed performances of Nora the piano-playing cat).

But others - the UN's Ban Ki-moon among them - will probably conclude that world domination by Psy is a much better prospect than world domination by another podgy Korean currently in the news.

"I hope that we can work together using your global reach," the secretary-general told Psy when the two met in October. "You have, I think, unlimited global reach."

To show how serious he was, Ban then had a stab at the horse dance.

"We have tough negotiations in the United Nations," he added, when he had recovered his composure (if not his dignity). "In such a case I was also thinking of playing Gangnam Style-dance so that everybody would stop and dance. Maybe you can bring UN style?"

Maybe. Keep watching YouTube. We could yet see Kim Jong-un horsing around in a Gentleman parody.

Follow us

Follow us on Facebook for discussions, entertainment, reviews, wellness and news.