The UAE has enjoyed a long, lively love affair with Guns N’ Roses – but now, we are ready to take that relationship to a whole new level.

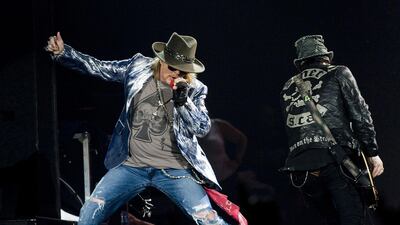

Over the years, there have been multiple visits from both of the band’s main players, and a few loyal sidemen. But tomorrow, audiences will see Axl Rose and Slash together on the same stage in the UAE for the first time.

The Not in This Lifetime... Tour, which kicked off last April, features guitar hero Slash and bassist Duff McKagan back in the band for the first time in 23 years. But over the past decade – during which the idea of such a “classic line-up” reunion was just a misty-eyed dream – loyal local fans have lapped up numerous chances to bathe in the bittersweet GN’R afterglow.

In early 2008, Slash and McKagan stole the show at Dubai Desert Rock Festival in the band Velvet Revolver – which also featured former Gunners drummer Matt Sorum. It was one of the supergroup’s final gigs before vocalist Scott Weiland quit to rejoin Stone Temple Pilots.

Nearly three years later, Axl brought his version of Guns N' Roses to Yas Island, in late 2010, on the final stretch of the band's decade-long tour in support of Chinese Democracy – the wildly delayed, sole non-Slash LP that was eventually released to global chagrin in 2008.

One of that version of the band's bit-part players was to prove a perennial UAE visitor. Guitar virtuoso Ron "Bumblefoot" Thal first appeared at Dubai's Hard Rock Cafe in 2012 to help local rockers Point of View launch their strong debut album Revolutionize the Revolutionary.

It was the beginning of a long-running relationship with the award-winning UAE band, which culminated in a joint tour of India, and follow-up gigs at The Fridge in 2013 and The Music Room in 2014.

When Axl brought his GN’R back to du Arena in 2013, Bumblefoot appeared onstage in a Point of View T-shirt.

On Friday, the PoV relationship reach another level, as the Dubai rockers to support the reformed Guns N’ Roses at the Autism Rocks Arena.

Axl's 2013 concert came just weeks after Slash brought his solo tour to Dubai Tennis Stadium, with a band that featured singer Myles Kennedy. They performed six GN'R classics, all from 1987 breakthrough album Appetite for Destruction.

The number of Guns N’ Roses tribute bands who have played The Music Room in Dubai would be embarrassing to count, if they had not proved to be so fun. A planned visit to the same venue by Gilby Clarke – GN’R’s rhythm guitarist during the world-conquering glory years of 1991 to 1994 – was cancelled in 2015, as was a gig at Abu Dhabi’s The Exchange Lounge, allegedly due to security concerns on the United Kingdom leg of the tour.

If all this proves anything, it is that the GN’R’s legacy runs far deeper than the fetishised early line-up. Even the touring juggernaut of the early 90s starred three non-founder members – Clarke, Sorum, and keyboardist Dizzy Reed, who joined in 1990 and is the only member aside from Rose to have enjoyed uninterrupted membership since then.

Friday night, then, is just the latest chapter in the ongoing love affair between UAE audiences and Guns N’ Roses – and don’t count on it being the last.

rgarratt@thenational.ae