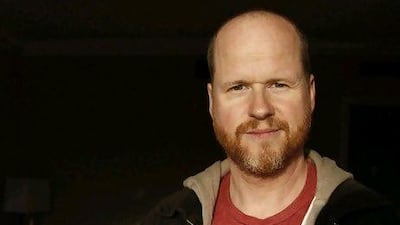

Following years of allegations about his on-set cruelty and incidents of misconduct involving stars such as Wonder Woman's Gal Gadot, Joss Whedon is finally speaking up. In a freewheeling interview with New York magazine's Vulture published on Monday, the Avengers director and creator of the cult show Buffy the Vampire Slayer defended his past actions and said he was made to "seem like I was an abusive monster".

“I think I’m one of the nicer showrunners that’s ever been," he told the magazine.

Whedon, who wrote and directed 2012's The Avengers, one of the highest-grossing films of all time, was first accused of being a "hypocrite preaching feminist ideals" by his ex-wife Kai Cole in an open letter published in 2017. Writing in The Wrap, Cole accused Whedon of cheating on her throughout their marriage, including with cast members of Buffy the Vampire Slayer.

Whedon acknowledges the affairs in the Vulture interview, saying "I feel terrible about them". He said that he felt "powerless" to resist the women because they were the sort who had ignored him when he was younger and that he would "always regret it" if he didn't give in while he was successful.

One of the biggest allegations against Whedon came early in 2020 when Justice League actor Ray Fisher called him "gross, abusive, unprofessional and completely unacceptable" in a series of tweets. Fisher, who played Cyborg in the film and who is black, also said Whedon digitally lightened his skin colour and cut his scenes.

Whedon, who was drafted in to complete the 2017 DC superhero film after director Zack Snyder left the project following the death of his daughter, told Vulture he lightened the entire film, not just Fisher's character, and that he cut down Cyborg's role because his storyline "logically made no sense" and that he was unhappy with Fisher's acting.

Fisher's accusations were widely reported, and led to Charisma Carpenter, who played Cordelia Chase in Buffy the Vampire Slayer and spin-off series Angel, posting a lengthy statement accusing Whedon of abusive behaviour on set.

"For nearly two decades, I have held my tongue and even made excuses for certain events that traumatise me to this day," the actress wrote. She accused Whedon of abusing "his power on numerous occasions" while she worked on both TV series, and also of "casually cruel" behaviour, which included threatening to fire her, calling her "fat" when she was four months pregnant, asking her if she was going to "keep" her baby, mocking her for her religious beliefs, and then "unceremoniously" firing her after she gave birth.

Whedon acknowledges he was not as "civilised" back then, but said he would never intentionally humiliate anyone. He said he had some regrets about how he spoke to Carpenter after learning she was pregnant, but was bewildered by her account of their relationship. "Most of my experiences with Charisma were delightful and charming. She struggled sometimes with her lines, but nobody could hit a punch line harder than her," he said. "I did not call her fat. Of course, I didn’t."

In May last year, Wonder Woman star Gadot told Israel's N12 News that Whedon threatened to have her fired after they had disagreements while filming Justice League.

“What I had with Joss basically is that he kind of threatened my career and said if I did something he would make my career miserable,” said Gadot, reiterating that she “handled it on the spot”.

Whedon denies this, saying "I don’t threaten people. Who does that? English is not her first language, and I tend to be annoyingly flowery in my speech."

Following Gadot's and Fisher's accusations, Warner Bros, which owns DC Films, launched an internal investigation into the Justice League set and announced “remedial action” had been taken. HBO also dropped Whedon as showrunner of The Nevers, a series he created about women with supernatural powers.

The Vulture interview, conducted over a number of months, also delves into Whedon's traumatic childhood, where he recalled being bullied by his older siblings. He also admits to seeking treatment for sex and love addiction.

“The beginning of the internet raised me up, and the modern internet pulled me down,” Whedon says in the interview. “The perfect symmetry is not lost on me.”