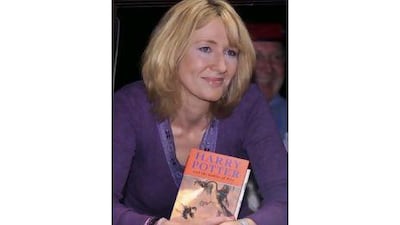

When the estate of Adrian Jacobs (a writer who died in 1997) launched a plagiarism case against JK Rowling, it wasn't the first time she had faced similar accusations. Nor is it likely to be the last, given that the woman behind the phenomenally popular Harry Potter series is thought to be the world's most wealthy author.

She has once again been vindicated, though, after a US judge recently dismissed a lawsuit proposing that she took parts of Jacobs's Willie the Wizard and repeated them in Harry Potter and the Goblet of Fire. According to lawyers acting on behalf of his estate, Rowling's ideas for wizards travelling on trains and even the wizard school itself all came courtesy of his book. Rowling has stated that she had never heard of Willie the Wizard before the copyright claim was issued in 2004.

One of the most well-known cases of plagiarism lodged against Rowling came from Nancy Stouffer, who wrote The Legend of Rah and the Muggles and Larry Potter and His Best Friend Lily, two books published in the 1980s. While it was acknowledged that spectacle-wearing Larry Potter did resemble the rather more famous Harry, Stouffer lost her court case and subsequent appeal.

In the past, Rowling has said that mythology and folklore, as well as Homer's Iliad, Chaucer's TheCanterbury Tales and Shakespeare's Macbeth have influenced various events in the books.