The wonders of Naguib Mahfouz’s novels are central to discussions at this year's Abu Dhabi International Book Fair.

The late Nobel laureate for literature is designated as this year's focus personality, and a series of panel discussions featuring authors and academics are being held to assess and celebrate the impact and legacy of Mahfouz’s work.

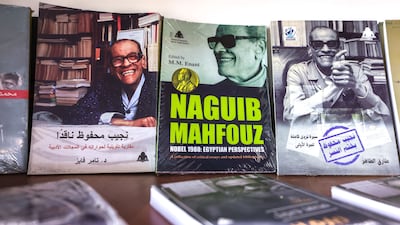

An exhibition dedicated to Mahfouz is also on-site at the event, which runs at the Abu Dhabi National Exhibition Centre until Sunday. It features video footage of previous interviews and a detailed timeline of his career. These sessions run in tandem with Egypt's designation as the guest of honour. There is a national pavilion dedicated to the country's literary history.

“You can't think of Egypt without Naguib Mahfouz and vice versa,” Berlant Qabeel, head of programming for the Abu Dhabi Arabic Language Centre, the organisation behind the book fair, told The National. “This was the reason behind the rare move to have this year's focus personality from the same country that is designated as guest of honour.

“Mahfouz represents the best of Arabic literature and he is the only Arab author to receive the Nobel Prize for literature. So we want to honour his work while showing how it remains relevant today.”

Ahmed Zayed, director of Egypt’s grand library Bibliotheca Alexandrina, believes Mahfouz’s keen eye on Egyptian society’s quirks and ills defines his work. “They portray beauty and imagination through a philosophical lens, which is exceptional,” he said at a panel discussion.

“This is evident in his depiction of societal images, beginning with the neighbourhood. He delves into the conflicts and yearnings for justice and revolution prevalent within it.”

Through family sagas such as The Harafish (1977) and the Cairo Trilogy series of novels (1956-1957), Zayed explained how Mahfouz used the plight of Egypt’s middle class to discuss the broader shape of Arabic society.

“It is evident in his trilogy, which elucidates the emergence and evolution of this social class,” he said. “The middle class serves as a gateway for him to provide some broader commentary about the world he was living in at the time.

“He writes about the improvements and developments of Egyptians, and in turn Arab societies, over the generations while at the same time alarms us about the present and upcoming difficulties they will face.”

Mohammed Afifi, professor of modern and contemporary history at Cairo University, described Mahfouz as being “obsessed” with history. He points to Beyond the Throne, the 1983 nonfiction work where Mahfouz recalls nearly 60 influential Egyptian leaders from Pharaoh Ramesses II to president Anwar Sadat as an example of how the past informed his work.

“It powered his narratives throughout his career and this is not really surprising considering the context in which he lived in that he was part of the generation that grew up through the Egyptian revolution of 1952,” he said.

“He continually sought to explore history and its significance and he became so adept and incisive that his work became a reference point into the Egyptian psych during his time.”

While Thebes at War (1996) and Arabian Nights and Days (1982) have a historical backdrop, Moroccan author and academic Said Bensaid Al Alaoui is reluctant to classify some of Mahfouz’s work as historical fiction.

“I have strong reservations regarding that term because the novel, in itself, serves to reflect history and society and Mahfouz's work does that regardless of its settings,” he said.

“For example a novel like 1966's Adrift on the Nile spans three quarters of the 20th century. It's a modern novel but also skilfully recalls Egypt's historical trajectory.”

Besides the life and times of Mahfouz, sessions with a distinct Egyptian flavour spanning culture, music, poetry performances and culinary exhibitions, are also taking place during the book fair.

“The choice of selecting Egypt for the first time as guest of honour at the Abu Dhabi International Book Fair is due to the strong relations between Egypt and UAE in all aspects, especially in the sphere of culture,” said Egypt’s minister of culture Nevine El Kelany at the national pavilion’s launch on Monday.

“Egypt’s participation at the book fair aims to reflect the culture and humanity of Egyptian civilisation for all.”