Almost a decade ago, Yasmine El Dorghamy took on a task that was borderline impossible in her native Egypt.

The daughter of an Egyptian diplomat, who spent her time criss-crossing the globe, attending schools in places as far apart as Greece, Mexico, Japan and Mauritius, El Dorghamy, 40, acted upon a lofty idea, but one that would keep her grounded: publishing a cultural periodical, Rawi (Storyteller), in Egypt that offers material inviting to ordinary folk yet nuanced and sophisticated enough for experts and academics.

El Dorghamy will publish an 11th edition next year, which will be her 10th anniversary issue, focused on the history of healing medical practices in Egypt. But it hasn’t been easy.

Egypt, now a nation of almost 100 million people, has traditionally been labelled the cultural centre of the Arab world, with its once-prolific film industry, theatre, book publishing and classical art forms, such as ballet and opera, setting it apart from the rest of the region. And while that’s no longer the case, at least not entirely – a condition brought about by economic woes, the rapid spread of religious conservatism and the emergence or growth of rival cultural centres – it still provides plenty of rich material for El Dorghamy’s magazine.

The challenge has been to keep the title financially afloat, not least in the current harsh economic climate. After years of political and economic turmoil in Egypt, it has been the devastating financial fallout from the coronavirus pandemic that has taken its toll this year. "We were slammed hard against a wall from day one," El Dorghamy tells The National.

Similar titles to Rawi have not been so lucky. The list of publications that have had to close because they're no longer commercially viable has grown. "Many superficially say that you cannot find enough readers for a publication like Rawi, but I have found out this was not true. They do exist and they are many. The problem is that publishing a good cultural product is prohibitively costly."

El Dorghamy says the magazine is sold on the news stand at a third of its production cost to make it accessible to more people, but that securing funds to publish it is difficult. “It’s nearly impossible in Egypt to finance anything that is not commercial,” she says.

That’s why she is tirelessly searching for funders to secure the magazine’s future. “I started learning every trick in the game,” the editor-in-chief wrote to a potential sponsor in a delicately penned letter that seamlessly mixed pragmatism and hope.

"How to cut costs, how to stay relevant (we produced some iconic covers), and how to keep enough people interested in order to stay afloat. I knew Rawi would not grow into the publishing company I had dreamt of any time soon, but if I could just keep it alive until we ride out the storm, there would be hope."

It all began for El Dorghamy when the inaugural edition of Rawi was published only two months before the 2011 uprising that toppled long-time president Hosni Mubarak – a particularly unstable time for a fledgling title. Nevertheless, El Dorghamy pressed on and the content of Rawi's initial editions was a "deliberate bouquet of diverse articles showing the many facets of Egyptian heritage".

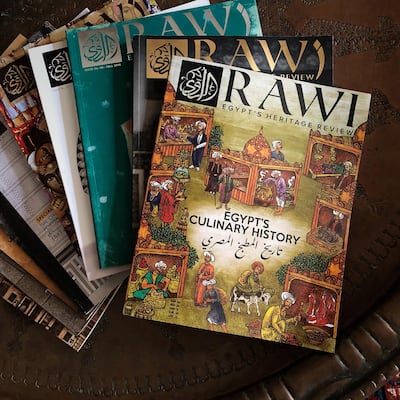

But the magazine later made a shift that has taken it where it is today. Every edition is now devoted to a single topic, from Coptic heritage to the jewellery industry.

The eighth publication was the first released in this “encyclopedic” style. Dedicated to the history of Egyptian modern art, it covered the main aspects of the topic offering a comprehensive timeline. Issue nine was on Egyptian cinema, while the 10th, and the latest edition, focuses on Egypt’s culinary history.

El Dorghamy recalls that the eighth issue was exceptionally difficult to put together. Given little had been written on the topic, she had to reconcile the contradictions in the literature she found and identify experts or academics reliable enough to write the articles. "We delayed publication for six months and in the end, it took us a total of 18 months to prepare, but it constituted a landmark in the history of Rawi," she says. "That edition, which has 200 pages, earned Rawi recognition and fame. Now, they teach from that edition in arts colleges in Egypt."

For El Dorghamy, 10 years in, she can see the impact the magazine has on its readers. “I tried to bridge the gap between the academic or the specialised and what is accessible, but now I feel I don’t need to do that any more. I don’t want to patronise my audience.”

She plans to engage with her readers through expansion into multimedia and special editions that can run at a shorter length. This will help the brand to stay relevant in a country where, as the case is in many others, the internet and streaming services have grown more popular than traditional media.

Rawi, like books, is up against tough competition from a host of forums for information and entertainment available on the internet and subscription-based streaming services. "People's concentration span is a problem. If you don't engage readers right away, they will leave you right away. You're competing with well-made series and documentaries on streaming services. Anyone who tells you that he or she is not reading less because of them is a liar."

It's against this backdrop that Rawi shines as evidence of an Egypt that continues to give in the face of formidable odds. It offers readers – in Arabic and English – a rich range of in-depth articles written by experts in their respective fields, as well as a generous dose of attractive visuals and fine printing.

More information is available at rawi-magazine.com