Britons selling their home in 2021 on average pocketed more than £95,000 ($128,859), with London sellers making the biggest gains.

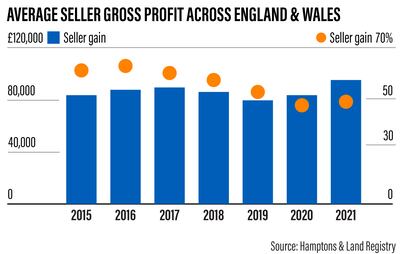

The average seller in England and Wales who bought their home within the past 20 years received £95,360 more than they paid for it, according to property consultancy Hamptons, up from the £83,550 in 2020.

Sellers offloading a detached house made even more, on average securing £151,840 from the sale, while those selling apartments saw their gains drop to £54,690.

“Soaring house-price growth over the last 18 months has driven up the amount of money homeowners have made,” said Aneisha Beveridge, head of research at Hamptons.

“But while owners of larger properties have benefited from buyers looking for more space, flat owners have seen weaker returns.”

Britain’s house prices rose 9.8 per cent in 2021 with an increase in cash terms of £24,500 – the biggest gain since 2003.

In December, prices rose 1.1 per cent from November, taking the average house price to a record high of £276,091 ($373,564), according to the latest Halifax House Price Index, as values were boosted by the stamp duty holiday and buyers hunting for more space.

Despite London recording the weakest growth, with values edging up just 2.1 per cent, according to Halifax, sellers in the city still made the biggest gains, Hamptons said, pocketing £197,730 on average from their sale.

On average, sellers in the capital owned their homes for 9.1 years before offloading it, securing an average gain of 58 per cent.

This was slightly down on the £207,370 made in 2020 and on the £243,050 secured in 2016, with the 2021 gross gain the first time London sellers made less than £200,000 since Hamptons began the study in 2015.

While 91 per cent of sellers in the capital secured a gain on their sale, in 16 per cent of flat sales the owner walked away with a loss as pandemic preferences led to buyers favouring bigger homes over apartments.

Meanwhile, sellers in the south-east also cashed in, with an average gain of £121,740, a gain of 47 per cent.

Ms Beveridge said house price gains are primarily driven by two factors – the length of time people have owned their home and the point at which they bought in the housing cycle.

“Typically, homeowners who have owned their properties for longer have seen more price growth and therefore made bigger profits,” she said.

“Although most of these profits are never seen by sellers as they are reinvested back into the housing market when they make their next purchase.”

Britons are also moving sooner, according to the study, after people reassessed their lifestyles in the wake of the Covid-19 crisis.

Sixty-four per cent of sellers sold their homes within 10 years in 2021, a rise on the 59 per cent recorded in 2019.